Agriculture grows world wonders

Here is my list of the top four most unique agricultural experiences in my life.

Read MoreFifty property owners spent a cold and icy evening with the Ashtabula County Auditor’s Office and representatives from other agencies learning about forestry tax programs this past week. The savings of these programs, anywhere between 50% to 95% of owner’s property taxes according to County Auditor David Thomas, was a big reason his office has been spreading the word.

The evening was focused on properties with woodlands and those interested in managing forests of over 10 acres in size. The two tax savings programs discussed were the Current Agricultural Use Value (CAUV) Woodland Program managed by the Auditor’s Office and the Ohio Forest Tax Law Forestry Program managed by the Ohio Division of Forestry.

“Our goal is to not only get folks the tax credits they deserve but also preserve a vital environmental and economical asset in our county’s woodlands,” Thomas said.

Heather Hall, CAUV specialist with the Auditor’s Office, and John Kehn, service forestry coordinator with the Ohio Division of Forestry, explained both programs and the requirements for property owners to apply and receive the tax incentives.

Entry into these opportunities takes three basic things, they shared:

“Both programs have pros and cons which we have easily available on our website along with other information,” Thomas said. “The key is becoming educated and learning about what is best for your property.”

Woodlands is the fastest-growing tax credit which property owners are being enrolled in over the past several years. Thomas attributes this to more education, a better economic output from responsible timbering, and the growing tax savings.

Parcels on CAUV woodland are taxed at the lowest possible value which is $230 an acre. This is significantly lower than most market values in Ashtabula County for woodlands which Thomas explains are between $2,000 to more than $10,000 an acre.

Also present at the education session was Ohio Farm Bureau Northeast Counties’ Organization Director Mandy Orahood. Orahood shared work Farm Bureau is doing with their legislative priorities to end a carve-out in Ohio law which does not permit properties in the CAUV Woodlands or Ohio Forest Tax Law programs to receive a non-business credit of a 10% tax reduction. Farm Bureau believes this is an unfair treatment of woodland owners as traditional farmers and agriculture producers can receive non-business credit.

“Due to our membership’s push at the local level to encourage this change in policy, Ohio Farm Bureau made the non-business credit issue a legislative priority in December and we’ve been excited to have Rep. Fowler Arthur and Auditor Thomas working to make it a reality for our farmers,” Orahood said.

Those who missed the session, but would like to learn about these opportunities can read more at the Ashtabula County Auditor’s website or contact Heather Hall at 440-576-3788. CAUV applications and renewals are due by Tuesday, March 1 to the Auditor’s Office.

Watch the video from the February 24 Education Session on Woodland CAUV and Ohio Forest Tax Law

Read the PowerPoint from the educational woodland CAUV session

Here is my list of the top four most unique agricultural experiences in my life.

Read More

A gardening Q & A related to planting date, fertilizer recommendations and other general gardening questions.

Read More

There is a lot of helpful information on the Trumbull County Auditor’s website to help you understand what is going on.

Read More

The presence of hundreds of farmers in downtown Columbus, filled with determination to advocate for their livelihoods and communities, served as a powerful reminder of the importance of our grassroots efforts.

Read More

I thought it would be interesting to ask consumers with no daily agriculture experience four questions, and see what they really have questions and concerns with.

Read More

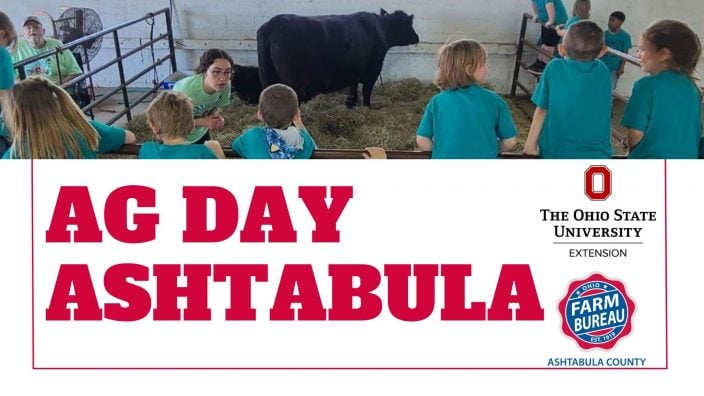

The Ag Day program May 10, 2024 is NOT open to the public. In order to volunteer, you MUST be registered. 300 volunteers are needed.

Read More

Understand the rules, restrictions around open burning in Ohio.

Read More

Utah’s diverse agricultural production contributes about $1.8 billion to the state’s economy every year.

Read More

Whether it’s getting involved in local boards or sharing our voices on national platforms, we all have a role to play in safeguarding the future of agriculture.

Read More

Our project was in agriculture literacy and made a huge impact on our local community, but even further abroad.

Read More