Don’t raise a stink over insect’s emergence

Stink bugs also known as the Brown Marmorated Stink Bug (BMSB in the entomology world) are one of the earliest signs of spring to me here in Ohio.

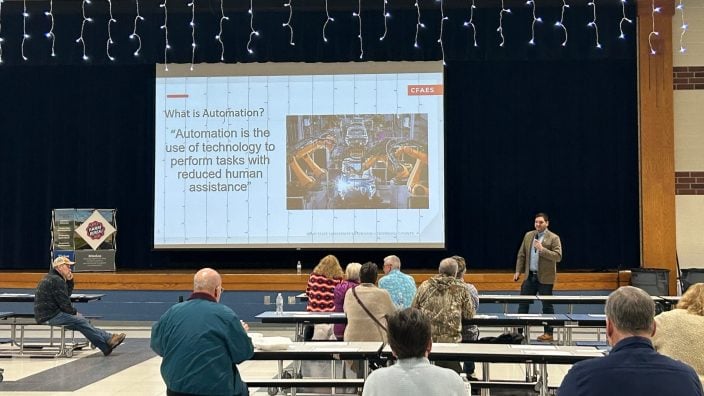

Read MoreFifty property owners spent a cold and icy evening with the Ashtabula County Auditor’s Office and representatives from other agencies learning about forestry tax programs this past week. The savings of these programs, anywhere between 50% to 95% of owner’s property taxes according to County Auditor David Thomas, was a big reason his office has been spreading the word.

The evening was focused on properties with woodlands and those interested in managing forests of over 10 acres in size. The two tax savings programs discussed were the Current Agricultural Use Value (CAUV) Woodland Program managed by the Auditor’s Office and the Ohio Forest Tax Law Forestry Program managed by the Ohio Division of Forestry.

“Our goal is to not only get folks the tax credits they deserve but also preserve a vital environmental and economical asset in our county’s woodlands,” Thomas said.

Heather Hall, CAUV specialist with the Auditor’s Office, and John Kehn, service forestry coordinator with the Ohio Division of Forestry, explained both programs and the requirements for property owners to apply and receive the tax incentives.

Entry into these opportunities takes three basic things, they shared:

“Both programs have pros and cons which we have easily available on our website along with other information,” Thomas said. “The key is becoming educated and learning about what is best for your property.”

Woodlands is the fastest-growing tax credit which property owners are being enrolled in over the past several years. Thomas attributes this to more education, a better economic output from responsible timbering, and the growing tax savings.

Parcels on CAUV woodland are taxed at the lowest possible value which is $230 an acre. This is significantly lower than most market values in Ashtabula County for woodlands which Thomas explains are between $2,000 to more than $10,000 an acre.

Also present at the education session was Ohio Farm Bureau Northeast Counties’ Organization Director Mandy Orahood. Orahood shared work Farm Bureau is doing with their legislative priorities to end a carve-out in Ohio law which does not permit properties in the CAUV Woodlands or Ohio Forest Tax Law programs to receive a non-business credit of a 10% tax reduction. Farm Bureau believes this is an unfair treatment of woodland owners as traditional farmers and agriculture producers can receive non-business credit.

“Due to our membership’s push at the local level to encourage this change in policy, Ohio Farm Bureau made the non-business credit issue a legislative priority in December and we’ve been excited to have Rep. Fowler Arthur and Auditor Thomas working to make it a reality for our farmers,” Orahood said.

Those who missed the session, but would like to learn about these opportunities can read more at the Ashtabula County Auditor’s website or contact Heather Hall at 440-576-3788. CAUV applications and renewals are due by Tuesday, March 1 to the Auditor’s Office.

Watch the video from the February 24 Education Session on Woodland CAUV and Ohio Forest Tax Law

Read the PowerPoint from the educational woodland CAUV session

Stink bugs also known as the Brown Marmorated Stink Bug (BMSB in the entomology world) are one of the earliest signs of spring to me here in Ohio.

Read More

Through all of life’s changes, Trumbull County has become not just a place we work, but the place we call home.

Read More

Most livestock animals are well adapted to cold weather, but farmers take extra measures when extreme temperatures come.

Read More

We often talk about the moments that shape us — big decisions, career paths and life milestones. But more often than not, it’s not the moments that define us. It’s the people.

Read More

I’m going to give you a list of things that you can do that will get you outside and actually enjoy the snow.

Read More

As kids, we are often told to try new things, whether it be a new food, a new activity or…

Read More

We aren’t just reacting to change — we’re shaping the future of agriculture, one conversation and one decision at a time, together.

Read More

Today, there are close to 15,000 farms growing Christmas trees in the U.S., and over 100,000 people are employed full- or part-time in the industry.

Read More

Our grassroots leaders are constantly raising the bar and finding new ways to show up and support their communities. ~ Zippy Duvall

Read More

In a world that can sometimes be so loud and busy, snow literally slows us down and quiets the sound.

Read More