At Nationwide, our past informs our future

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read MoreThese criminals want your information, so they can commit identity theft or fraud, which can be avoidable if you take the right precautions.

Every day, thousands of unassuming Americans are tricked into revealing confidential information. An attacker may seem legitimate and respectable, possibly claiming to be a new employee, repair person, or researcher and even offering credentials to support that identity.

These criminals want your information, so they can commit identity theft or fraud, which can be avoidable if you take the right precautions.

There are three main types of scams that are commonly used to attempt to steal your identity and your money: Phishing is a method which uses email as a source; smishing uses SMS or text messages; and vishing is done over a phone conversation.

“I don’t think you can say there is a target audience or age demographic anymore; we are all targets,” said Jason Bohr, Nationwide’s threat intelligence consultant. “With that said, the less tech savvy you are the more vulnerable you may be.”

No matter what technique is used, there are some red flags to be aware of if someone is trying to scam you. One of those indicators is if a change in payment is being requested.

“Especially if those requests are going to be via ACH or EFT, being transferred through a wiring service or done through gift cards,” said Ryan Praskovich, cyber fraud capability lead with Nationwide. “It always happens in a particular formula, which starts with a reason why the payment change is needed and, ironically enough, the word ‘kindly’ is frequently used which is very rarely used in legitimate emails and conversations.”

Praskovich said another important step to protecting yourself from scam artists is to verify the email address or phone number that is reaching out to you. A simple online search can tell you if an email address is slightly changed or if a phone number isn’t associated with the company the person on the other end claims to be with.

Despite being aware of some of these watchouts, one of the most common mistakes is responding to a suspicious email, text or voicemail.

“In essence, that is the worst thing to do because now your information may be compromised,” Bohr said. “The threat actors will respond immediately and will continue to make their role within a company and the request they are asking of you more and more believable.”

Bohr advises that if something sounds too good to be true, it more than likely is and to verify who you are dealing with first before getting too far down the path of a scam.

“Many people that have fallen victim to these types of crimes have done so because the process just moved too quickly after letting their guard down,” Bohr said. “Even if an email or a call comes from someone you think you know, it’s important to take some extra steps to keep yourself protected.”

Praskovich recommends passwords be longer than 8 characters and don’t use the same password to log into multiple accounts.

“It may be easier to remember one password, but it only takes you entering your credentials once for scammers to have access to all of your accounts,” Proskovich said. “No matter how complicated you think your passwords are, it only takes 5 hours or less to crack an 8 character password. Long, complex passwords can go a long way in protecting you online.”

Bohr and Proskovich shared more of their expertise and how they keep Nationwide associates protected from scam artists on a recent Ohio Farm Bureau Podcast.

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

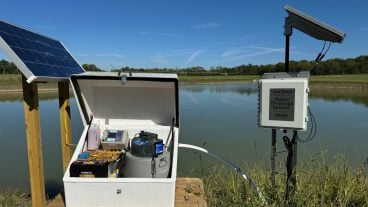

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More