At Nationwide, our past informs our future

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read MoreThe IRS tax code Section 179 deduction is a way to reduce the total cost of new equipment and machinery by enabling the buyer to claim full depreciation in year one.

The following information is provided by Nationwide, the No.1 farm and ranch insurer in the U.S.¹

The IRS tax code Section 179 deduction is a way to reduce the total cost of new equipment and machinery by enabling the buyer to claim full depreciation in year one. Normally, that depreciation (referred to as “bonus depreciation” by the IRS) would be parceled out annually over the time the purchase is financed. You should consult with your personal tax advisor for guidance on Section 179.

According to the IRS, Section 179 deduction was expanded in 2018 to cover both used and new qualifying equipment.

Under Section 179, you can choose which purchases to cover and which you would like to save as future tax breaks. Some farmers and ranchers choose to split the Section 179 deduction for individual purchases in their year-over-year tax planning. You should consult with your personal Tax Advisor for guidance on Section 179.

“In years past, when your business bought qualifying equipment, it typically wrote it off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off $10,000 a year for five years,” according to Section179.org, a hub of information on the deduction. “Now, while it’s true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it. And that’s exactly what Section 179 does — it allows your business to write off the entire purchase price of qualifying equipment for the current tax year.”

According to the IRS, anyone buying, financing or leasing new or used equipment will qualify for a Section 179 deduction, provided the total amount is less than the yearly cap. For farmers, that typically means equipment, machinery, tools and software purchased between Jan. 1 and Dec. 31.

For example, on equipment purchases of $1.15 million, the first-year write-off is typically $1.05 million, with a bonus first-year depreciation of $100,000. After Section 179 and bonus depreciation are claimed, straight-line depreciation may kick in after the effectiveness of the two prior forms of depreciation are utilized. Straight-line depreciation allows equipment purchased to be depreciated at a rate spread over the remaining years of its expected salvage value. For a piece of equipment with a useful life of five years, that means the total value declines by 20% each year. To leverage a Section 179 deduction in a case like this example, the first step is to consult with your personal tax advisor.

While the tax incentives under Section 179 are appealing to drive down income, farmers and ranchers should avoid depending only on this Code section. “Section 179 is certainly a powerful tool for farmers, but it also comes with some items to watch out for. If you sell the asset you took a 179 deduction on prior to the end of its’ useful life you will be subject to recapture rules. Additionally, if you are planning to transition your operation to the next generation you may be building up a tax wall that may hinder your ability to effectively and efficiently transition those assets how you desire,” said Steve Hamilton, JD of the Nationwide Retirement Institute.

You and your tax professional can reference Section179.org for information you need to make the most of the Section 179 deduction and bonus depreciation before the end of the year. Find additional ideas to protect and strengthen your operation at aginsightcenter.com.

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

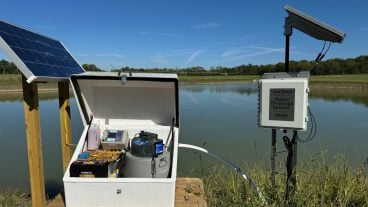

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More