Standing up for farmers

‘We never stop pushing to ensure farmland taxation is fair and reflects the realities of agriculture.’ ~ Mandy Orahood

Read MoreCAUV is perhaps the most important public policy achievement Ohio Farm Bureau has ever accomplished and the most impactful farmland preservation/food security policy the state of Ohio has ever supported.

Editor’s Note: This editorial from Ohio Farm Bureau President Bill Patterson was published in the July/August 2024 Our Ohio magazine.

If it were not for CAUV, many farm families couldn’t afford to farm in Ohio: Property taxes alone would gobble up whatever profits many farm businesses might have.

That simple fact makes CAUV perhaps the most important public policy achievement Ohio Farm Bureau has ever accomplished and the most impactful farmland preservation/food security policy the state of Ohio has ever supported.

But the fact that CAUV has been established for more than 50 years doesn’t mean we can take it for granted. The voices opposed to CAUV say it gives farmland owners a free ride on property taxes and stymies growth. The opposing voices represent powerful influences in the General Assembly. And they are vocal in their opposition. One elected official said, in public, that Ohio has nearly eliminated taxation on ag properties. Did you catch that? The official said you don’t pay property taxes because of CAUV.

Recent property tax spikes for all Ohioans has lawmakers asking tough questions about our state’s tax policy. As you’ve seen in this issue of Our Ohio, even though CAUV keeps property taxes in line with the agricultural production value of farmland, the program doesn’t protect farms from seeing big fluctuations in valuations.

OFBF board member Matt Aultman, who farms in Darke County, recently testified before the Joint Committee on Property Tax Review, that he saw a 94% increase in average CAUV values. In the last seven revaluations, going back nearly 20 years, our average CAUV values increased more than 100% five times. This is an unsustainable trend that has made it very difficult for farms of all sizes to remain profitable.

Ohio Farm Bureau’s voice in this debate about taxes came about because of our quick action in 2023 when members engaged their legislators. The result of that work is the newly formed Joint Committee on Property Tax Review. We see it as a great opportunity to seek additional improvements to CAUV and the property tax system as a whole.

With farm incomes projected to drop 25% this year, the issue of property taxation is one of the biggest challenges our members face. As Matt testified, “The property tax bill always comes due, whether we face floods, droughts or any other unpredictable events, and the volatility in the current system is frankly leaving many farmers struggling to turn profits year in and year out. Finding a way to limit volatility in our property tax system must be accomplished so that we are not only not taxing residents out of their homes, but so that the backbone of Ohio’s economy – agriculture- can continue to survive.”

Our work to protect and refine CAUV continues. And, as always, membership makes it happen.

‘We never stop pushing to ensure farmland taxation is fair and reflects the realities of agriculture.’ ~ Mandy Orahood

Read More

In this recording, learn about the recent increases in Ohio CAUV values, gather information to help you understand the property tax system, and get an update on legislative action.

Read More

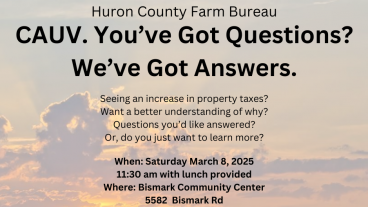

Join us for an informative session March 8. Experts will explain recent changes, answer your questions, and help you better understand how CAUV impacts you.

Read More

Lorain County Farm Bureau hosted a CAUV meeting Jan. 30, 2025 at LCCC Wellington Center presented by the Lorain County Auditor’s Office and Lorain County Farm Bureau.

Read More

Join Ohio Farm Bureau for a free webinar Feb. 11 to discuss the recent increases in CAUV values, Registration is required.

Read More

Join us Jan. 30 for a CAUV Overview Meeting at Lorain County Community College.

Read More

Jan. 9 Morgan County Farm Bureau will be sponsoring a Landowner information meeting with the County Auditor’s office.

Read More

Ohio Farm Bureau is continuing to work multiple channels to address concerns around CAUV – particularly the issue of values spiking significantly.

Read More

An upward trend in CAUV values and significant increases in soil values for 2024 apply only to counties that are being reappraised or updated in 2024.

Read More

The July/August 2024 Our Ohio magazine takes a deeper dive into a program that impacts nearly all members across the state, CAUV.

Read More