At Nationwide, our past informs our future

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read MoreStaying on top of your insurance coverage can help keep unexpected expenses like rising replacement costs from cutting potential farm revenue.

The following information is provided by Nationwide, the No. 1 farm and ranch insurer in the U.S.

There’s a lot happening around the world that’s applying downward pressure to revenue prospects for farmers. Inflation, logistical hurdles, rising energy and crop input prices at home and conflict overseas could all continue to contribute to the erosion of farm revenue potential.

But maximizing farm revenue requires investment. That investment is likely to come with some sticker shock this spring and beyond. The right insurance coverage can help.

Staying on top of your insurance coverage can help keep unexpected expenses like rising replacement costs from cutting potential farm revenue. A close eye on your coverage and a call to your agent can help make sure these costs don’t add to the financial pressure caused by inflation and other factors at home and abroad.

“All of these issues have a big impact on farm operational costs. We’re seeing higher prices for energy, machinery and many other inputs,” said Nationwide Senior Economist Ben Ayers. “It puts a lot of pressure on revenues many farmers are facing.”

During this time of uncertainty, Nationwide and your local Nationwide farm agent are working hard to help farmers maintain the right coverage levels without incurring too much additional cost. Now is time to talk with your agent.

During this time of uncertainty, Nationwide and your local Nationwide farm agent are working hard to help farmers maintain the right coverage levels without incurring too much additional cost. Now is time to talk with your agent.

“My immediate concern is making sure you have adequate coverage,” said Nationwide Associate Vice President for Agribusiness Regional Sales Nick McCleish. “We have to make sure the amount of insurance is keeping pace with rising costs.”

McCleish cites a recent example when a farmer had to replace a $75,000 grain cart. But at the time of replacement, the price for that grain cart had surged to $90,000. That meant the farmer paid the additional cost out-of-pocket. “Paying those types of increased costs become much more difficult if you don’t keep your policy updated,” McCleish said.

The optional inflation guard coverage can help prevent such revenue losses by increasing dwelling and structure coverage limits at policy renewal. Also known as Construction Cost Adjustment, it helps to account for inflation in replacement or construction costs based on appraisals.

But inflation guard doesn’t always cover all additional costs. It’s important to have a good idea of costs for things like building materials and equipment ahead of time. Then match coverage levels to potential unexpected replacement or repair needs.

“Your insurance should not be a ‘set-it-and-forget-it’ type of activity. Keep your agent up to speed on how your operation’s changing. Make sure you’re covered appropriately,” McCleish said. “Have an agent that understands your operation, and the uniqueness of what you’re trying to do. Our Farm Certified agents serve that purpose.”

Visit AgInsightCenter.com for more expert tips and information from Nationwide.

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

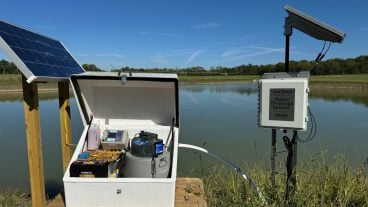

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More