At Nationwide, our past informs our future

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read MoreThe right machinery replacement strategy can help ensure you’ve got what you need to continue to evolve your business well into the future.

The following information is provided by Nationwide, the No. 1 farm and ranch insurer in the U.S.¹.

Some farmers replace machinery every year. Others “run it until the wheels fall off.” Where you fall in the range between those two extremes determines how to best approach evolving your farm machinery lineup. The right machinery replacement strategy can help ensure you’ve got what you need to continue to evolve your business well into the future.

Farm machinery and equipment costs change over time. Things like depreciation, risk management expenses and increasing operating and maintenance costs affect how you approach the machinery replacement decision. Among these other variables, consider risk management in making an informed, financially smart decision.

If you normally trade tractors every five years and are looking to extend that by a couple years to save money, think about how that change will affect your farm in the long term, according to Nationwide Senior Consultant Erin Cumings. Trading machinery even a year later than normal affects things like residual value and available replacements.

“Inflation has caused machinery costs to escalate at a time where parts availability could also impact our ability to keep our existing equipment running,” Cumings said. “When you consider these types of factors, we can’t lose sight of business continuity, or what you do in the case of down-time, especially for key pieces of machinery.”

An informed machinery replacement strategy accounts for five variables, according to retired Iowa State University Extension Economist William Edwards:

How your machinery replacement plan fits into a broader business continuity strategy should incorporate risk management. Fortunately, policy options like Replacement Cost coverage can help ensure you’re adequately compensated if you incur a loss. And there are other policy and endorsement options for just about any replacement strategy, according to Cumings. Just confirm what you need and what it will cost before you step into the machinery dealership.

“If you’re considering adjusting your machinery replacement strategy to limit the risk of down-time, it’s important to know what is and isn’t covered,” Cumings said. “Your farm insurance from Nationwide may include limited coverage for borrowed, rented or leased equipment. But that generally excludes damage from wear and tear or mechanical breakdowns. It’s important to talk to your agent about your coverage needs.”

Visit AgInsightCenter.com for more resources and expert tips on trending topics to help you run a successful business and maintain the safety of your operation.

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

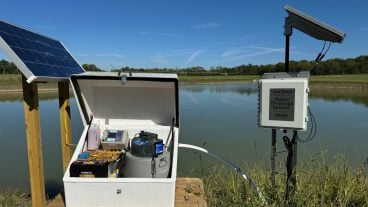

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More