Applications for Ohio Farm Bureau Health Plans now available

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read MoreThe recent CAUV reforms more accurately value land in conservation, but some landowners need to get with their county auditor to take advantage of the changes, said Leah Curtis, OFBF policy counsel and senior director of member engagement.

“What we worked toward was getting the conservation acreage valued at the lowest value in the CAUV table,” she said. In doing so the value recognizes that the land is not making an income for the landowner, yet it is serving a purpose by helping keep the environment healthy.

Landowners who have conservation land that falls under CAUV in one of the 41 counties reappraised or updated in 2017 will need to talk with their county auditors soon, Curtis said. Proof that their land is in a federal conservation program or simply in a conservation practice will have to be presented. A map of where that acreage is and, if in a federal program, a signed contract to confirm the land is in the program will need to be presented to the auditor so he or she knows exactly what soils need to be lowered to the conservation acreage.

“If you just talk to your auditor, you can work through this so you have the right value for the coming year,” Curtis said.

If landowners don’t talk to the county auditor, the land will not be lowered to its lowest CAUV value, Curtis said. For 2017 reappraisals to be eligible for the new valuation, the land must be in a conservation practice as of Jan. 1, 2017.

As for those living in a county that will be reappraised or updated in 2018 or 2019, Curtis said those landowners will see this change included with all other reform changes when those reappraisals and updates happen in their counties.

“When you fill out your renewal form for CAUV each year, there will now be a place to certify your conservation acreage, both federal program acreage and general conservation practice land,” she said. Again, a map of the land must be included, as well as a signed contract produced if it is in a federal conservation program.

It is important to note that when the conservation land is lowered to its new value, it must remain in conservation practice for three years, Curtis said. If it is taken out of that practice prematurely and used to generate income, the landowner is responsible for paying the difference between the lowered CAUV conservation value and its typical CAUV value. That land will go back to typical CAUV value, Curtis said.

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read More

Collegiate Farm Bureau serves as a connection to current industry professionals and equips the next generation with the essential tools and resources needed to excel in their careers.

Read More

Ohio Farm Bureau members met one-on-one with state legislators and staff to discuss policy priorities impacting Ohio’s farms and rural communities.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

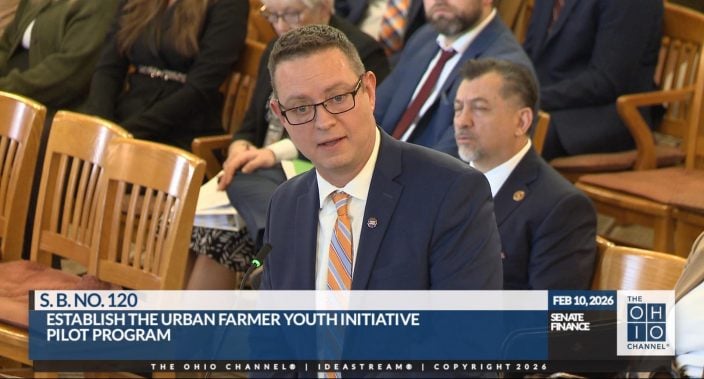

Introduced by Sen. Paula Hicks-Hudson, SB 120 would establish the Urban Farmer Youth Initiative Pilot Program.

Read More

Gases, vapors, and fumes can all create risk. How can we measure and protect ourselves from them?

Read More

The Ohio Farm Bureau’s Young Agricultural Professionals State Committee has named its 2026 leadership and the individuals who will be serving on the state committee for 2026-2028.

Read More

The Ohio Farm Bureau Foundation has multiple scholarships available to Ohio students from rural, suburban and urban communities who are pursuing degrees with a connection to the agricultural industry.

Read More

With 100% bonus depreciation now permanent, farmers can deduct the full cost of a new agricultural building in the year it’s placed in service.

Read More