Applications for Ohio Farm Bureau Health Plans now available

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read MoreFor many farmers, retirement is just not something they intend to do. While the average age of a U.S. farmer continues to climb and now stands at 57.5 years, health issues may force some operators to retire or semi-retire from the day-to-day farm activities earlier than intended. A large consideration facing aging farmers or ranchers is the health care options available to them and how they will pay for these services. For many Americans 65 and older, the answer is Medicare.

Individuals are entitled to Medicare so long as they are a U.S. citizen or permanent legal resident of the U.S. who has lived in the U.S. for at least five years. The program’s benefits can be great but determining the participation level to elect can be somewhat confusing.

Most farmers qualify for Part A coverage under Medicare at no out of pocket expense so long as either the individual or his or her spouse has paid Medicare taxes for at least 10 years. Care under Part A only covers inpatient hospital stays and/or a skilled nursing facility. This leaves many individuals seeking additional coverage for doctor services, outpatient care, vision, dental, hearing and potentially other care needs not covered under Part A. These additional services are generally covered though Part B and Part C of Medicare. However, unlike Part A, individuals wishing to participate in these additional coverages will be required to pay the additional premiums associated with those plans. Combined costs could be hundreds of dollars monthly and prove to be burdensome to not only the individual but potentially the farm as well.

One way to plan for these costs is to set aside funds to provide the additional level of income that will be needed to pay for these premiums. To determine the appropriate amount of funds to set aside, it is critical to determine what coverage is desired and its associated cost. Nationwide, in partnership with leading physicians and other professionals, created a tool that analyzes your personal health and lifestyle information, healthcare costs based on your region, actuarial data and medical coverage to estimate the additional costs of healthcare beyond your Medicare Part A coverage.

To learn more, register for an online learning session.

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

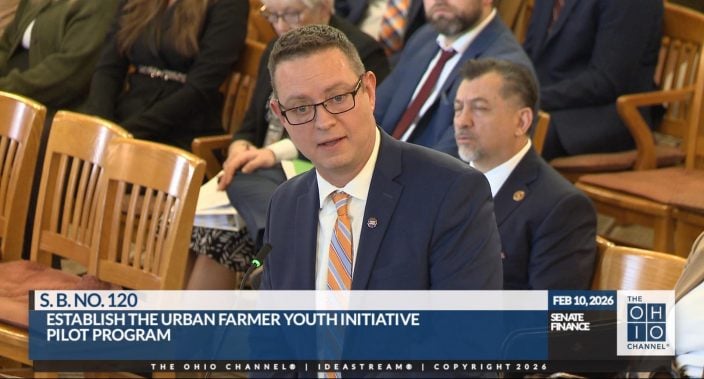

Introduced by Sen. Paula Hicks-Hudson, SB 120 would establish the Urban Farmer Youth Initiative Pilot Program.

Read More

Gases, vapors, and fumes can all create risk. How can we measure and protect ourselves from them?

Read More

The Ohio Farm Bureau’s Young Agricultural Professionals State Committee has named its 2026 leadership and the individuals who will be serving on the state committee for 2026-2028.

Read More

The Ohio Farm Bureau Foundation has multiple scholarships available to Ohio students from rural, suburban and urban communities who are pursuing degrees with a connection to the agricultural industry.

Read More

With 100% bonus depreciation now permanent, farmers can deduct the full cost of a new agricultural building in the year it’s placed in service.

Read More

Lincoln Deitrick was named the Outstanding Young Farmer, Denver Davis won the Excellence in Agriculture Award, and Margaret Houts won the Discussion Meet.

Read More

Michelle Downing of Franklin County has been named finance director of county operations for Ohio Farm Bureau.

Read More