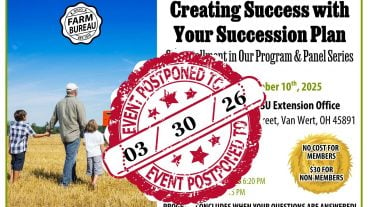

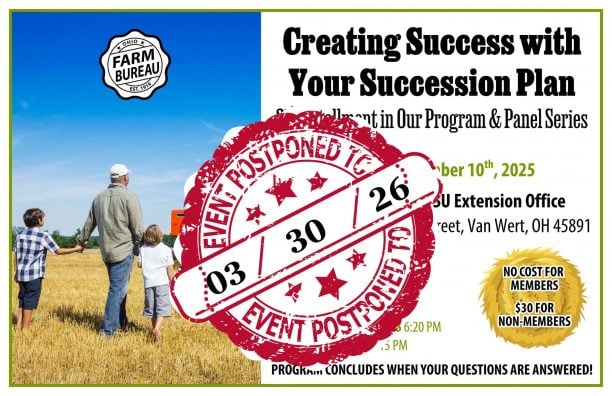

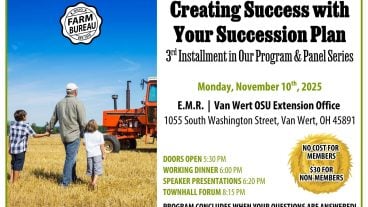

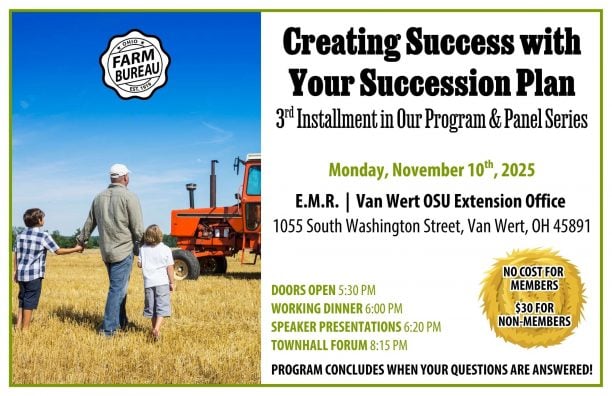

Creating success with your succession plan – RESCHEDULED

This evening’s “Creating Success with Your Succession Plan” Program & Panel Event has be postponed to Monday, March 30 due to illness and inclement weather.

Read MoreA transition plan will help you ensure that your (and your family’s) wishes are met, emotional stress is minimized, and financial risks and opportunities are addressed.

The following information is provided by Nationwide, the No.1 farm and ranch insurer in the U.S.¹.

Finding time to talk to your family about succession planning for your farm may be difficult.

Finding time to talk to your family about succession planning for your farm may be difficult.

You may also be uncomfortable with the thought of selling your farm or handing over control to family members.

But making the time to develop a transition plan for your farming business will help you ensure that your (and your family’s) wishes are met, emotional stress is minimized, and financial risks and opportunities are addressed.

Business entity ownership

This option creates “unit (or share) values” for a farm business structure, much like a Limited Liability Company or corporation. This way, a predecessor can gradually increase the successor’s ownership rights over time to keep farm equity management control in the hands of the active farmer while still passing on assets to other heirs.

Buy/sell arrangement

This arrangement provides a legal structure for the successor to purchase the farm upon certain life events, like a severe illness or death. It’s often funded with life insurance that will someday be used both to purchase the operation at an agreed-upon price and to be able to “buy out” any nonfarm heirs.

Installment sale

Especially for farms seeing rapid growth, an installment sale is one way to essentially “freeze” the value of the farm. The successor begins making installment payments over an agreed-upon time frame. This helps transition farm assets to the successor over time and avoids federal estate taxes on any future growth of the operation.

Intentionally defective grantor trust

As another way to freeze farm assets, creating an IDGT can help the predecessor transfer farm assets through a trust. It’s similar to an installment sale, but the assets go into the trust, not directly to the successor. The trust can provide greater control of the assets. This can be complicated, so it requires the guidance of a knowledgeable attorney.

Inheritance offset

The predecessor can make the non-farm heirs beneficiaries of their life insurance in equal amounts and leave farm assets to the successor. This way, all heirs receive the same amount, but the farm stays in the hands of the new owner

and operator.

You can trust Nationwide to help guide you throughout the transition planning process. Contact your local Nationwide office to learn more.

[¹] *A.M. Best Market Share Report 2022.

Nationwide, the Nationwide N and Eagle, and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2023 Nationwide.

This evening’s “Creating Success with Your Succession Plan” Program & Panel Event has be postponed to Monday, March 30 due to illness and inclement weather.

Read More

Success is NOT something you can simply find; you MUST create it for the sake of yourself, your family, and your operation. This…

Read More

Find out what some of the priciples of a succession plan are and how they are being used by Wright and Moore, on this Ohio Farm Bureau Podcast.

Read More

Does your succession plan pencil out financially? Learn more from Wright and Moore’s Ryan Conklin.

Read More

Get experts tips on successful succession plans and the timing for moving assets to the next generation. Plus, hear from Leah Curtis.

Read More

Dr. Ron Hanson helps counsel farm families to resolve conflicts while helping the next generation assure their financial future. He is a featured speaker at the 2025 Winter Leadership Experience.

Read More

Meet this year’s Golden Owl Award winner and learn about new research that was just conducted by Ohio State around the topic of farm succession planning on this Ohio Farm Bureau Podcast.

Read More

A transition plan will help you ensure that your (and your family’s) wishes are met, emotional stress is minimized, and financial risks and opportunities are addressed.

Read More

The group can help with farm transitions, farm lease agreements, land use zoning issues and farm business consultation.

Read More

What does the future of the farm look like when the older generation is no longer a part of what happens day to day?

Read More