Legal with Leah: Insight on Recent Property Tax Legislation

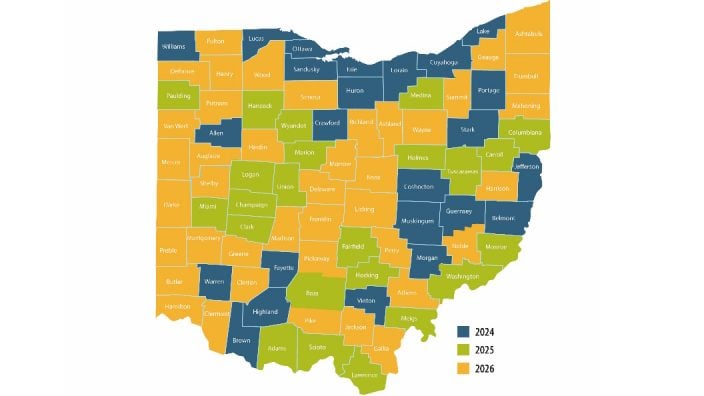

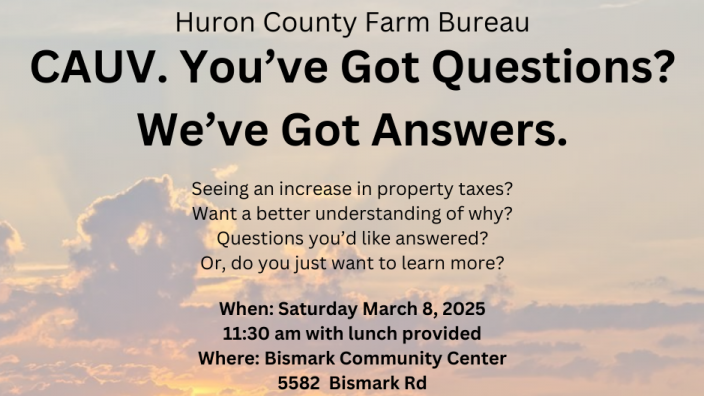

Four property tax reform bills were signed into Ohio law at the end of 2025. Ohio Farm Bureau Associate General Counsel Leah Curtis breaks down the bills and what the changes mean for Ohioans.

Read More