At Nationwide, our past informs our future

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read MoreThe following information is provided by Nationwide, the official insurance and financial services provider of Ohio Farm Bureau.

If you actively work to secure your family farm legacy and preserve assets in an estate plan, a key tax law change is coming.

Staying ahead of that change can help minimize the tax burden of transferring assets from one generation to the next. Here’s what to know to ensure your farm estate plan is taking full advantage of the law set to sunset in December 2025.

The Tax Cuts and Jobs Act (TCJA) of 2017 provided federal tax exemptions for up to $13.61 million in assets transferred by individuals. That limit is doubled for married couples. But the law is sunsetting Dec. 31, 2025. The exemption limit after that date will revert to $5 million per person (adjusted for inflation). That makes now a good time to consult with your personal tax adviser regarding your plans for gifting large farm assets from a farm estate so you can maximize tax savings.

Currently, any assets gifted as part of a farm estate plan beyond the inflation-adjusted $13.61 million threshold is subject to federal tax up to 40%. Once TCJA sunsets, that same estate tax liability will be applied to any gifted asset beyond $5 million. This can ramp up the potential financial burden without the right estate planning. Ultimately, this could mean liquidating assets that could disrupt long-term financial planning or the execution of family inheritance.

In addition to accounting for the tax law change coming in late 2025, there are other strategies farmers should consider to help maximize current and future tax exemptions in your farm estate plan. When considering these optional strategies, be sure to always work with a trusted financial professional and an estate planning attorney to help build an estate plan that supports your unique circumstances.

Annual gifting | The annual gift tax exclusion allows individuals to gift up to $18,000 per person in real value with no tax penalty. That tax-free gift is doubled to $36,000 when given by a married couple.

Family limited partnerships (FLP) or family limited liability companies (LLC) | These structures allow wealth transfer while retaining control over assets. Such structures can offer valuation discounts that reduce taxable estate values.

Charitable remainder trusts (CRT) and irrevocable life insurance trusts (ILIT) |

These types of trusts can provide income streams and reduce taxable estates. In many cases, assets dedicated to charitable giving or life insurance are kept out of an estate and are not subject to estate taxes.

Grantor retained annuity trusts (GRAT) and qualified personal residence trusts (QPRT) |These types of trusts allow asset transfer with reduced estate tax implications. GRATs offer annuity payments before passing remaining assets to beneficiaries. QPRTs involve transferring residences to trusts, allowing continued living in the home for a set time.

While legislative extensions could keep the current TCJA exemption limits, there are no guarantees. Acting now helps you take advantage of a potential once-in-a-lifetime opportunity to save on estate taxes.

Estate planning is not just about preserving wealth. It’s also securing your legacy and ensuring your farm operations continue smoothly across generations. By preparing for these changes, farmers can help maintain their operations’ economic sustainability and foster continued growth. It’s what the Nationwide Land As Your Legacy program is all about.

Nationwide and its representatives do not give legal or tax advice. An attorney or tax advisor should be consulted for answers to specific questions.

Nationwide, the Nationwide N and Eagle, and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. © 2025 Nationwide.

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

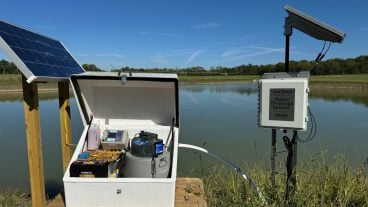

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More