Who oversees CAUV appraisals in Ohio? A farmer

Kelly Tennant’s story starts as many others in agriculture do, but her current day job impacts Ohio ag more than most.

Read More

Kelly Tennant’s story starts as many others in agriculture do, but her current day job impacts Ohio ag more than most.

Read More

Learn more about eligibility and how to include conservation practices on CAUV enrollment forms.

Read More

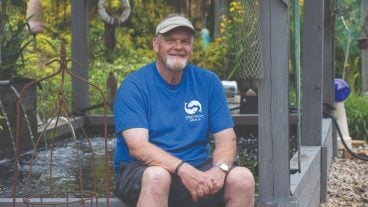

Bob and Polly Givens are on a mission to inform small landowners-homesteaders of the advantages of CAUV.

Read More

Mark DePugh was on the fence about renewing his CAUV enrollment, until he realized the amount of tax savings he would be missing.

Read More

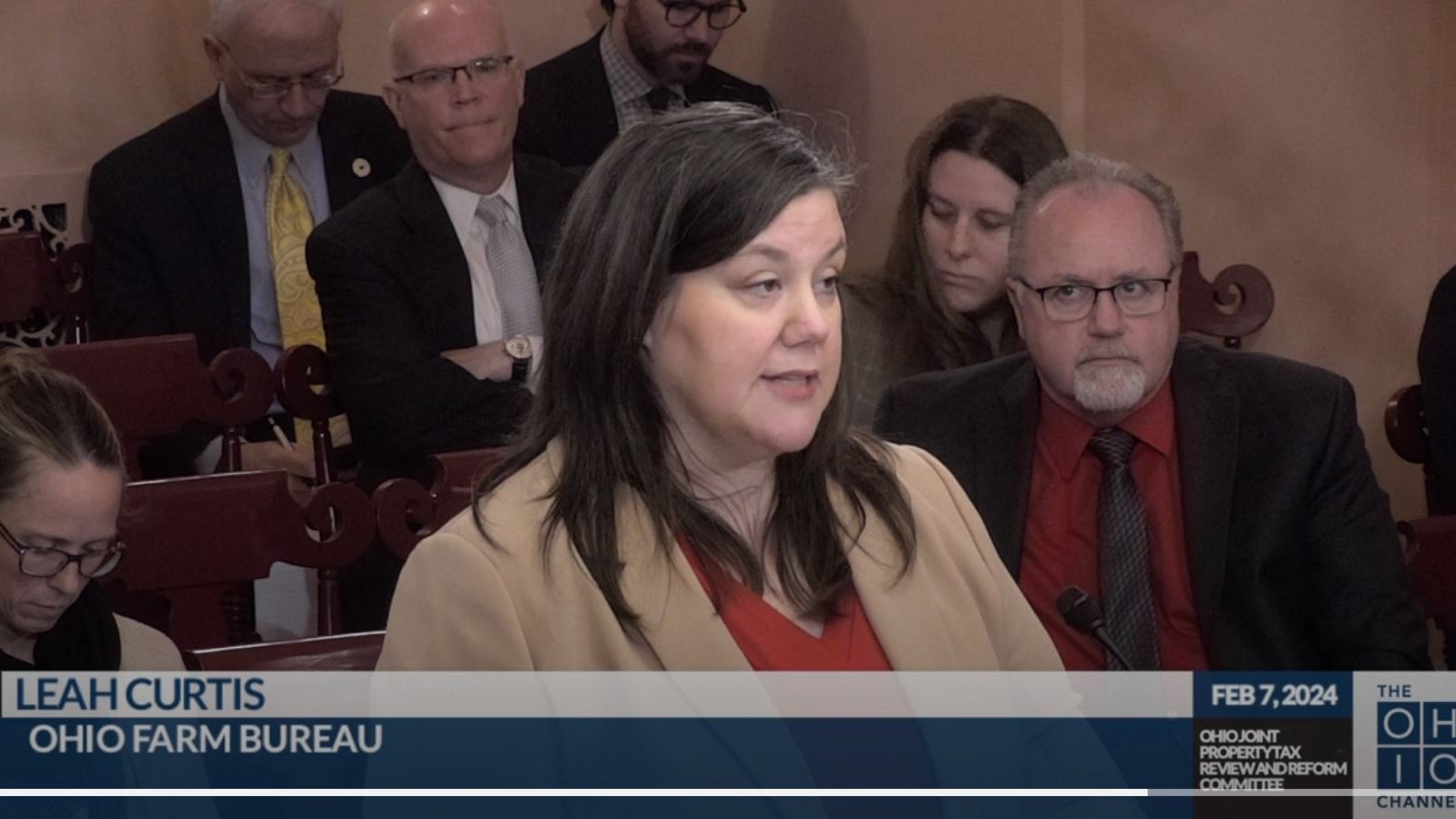

Farm Bureau’s role in supporting the agricultural community is crucial, especially during times of significant change and uncertainty.

Read More

Leah Hetrick, with the Ohio Farm Bureau, will discuss the recent increases in CAUV values, information to help you understand the property tax system, and an update on legislative action.

Read More

farmers are happy with the purpose and philosophy of the CAUV program, but all would prefer some more predictability in their values and more importantly, their tax bill.

Read More

Understanding the Current Agricultural Use Value program and proper forestry management could lead to increased profits and sustainable land use.

Read More

CAUV values are set to increase substantially in the 2023 reappraisal/update, affecting 41 counties.

Read More

Thanks to the work of Ohio Farm Bureau members through the organization’s Action Alert process, the budget will avert the potential negative impacts of a proposed property tax policy change.

Read More