Washington County Farm Bureau hosts CAUV meeting

Leah Hetrick, from Ohio Farm Bureau, explained how CAUV works and how the equation used to determine property taxes works.

Read MoreFarmers are happy with the purpose and philosophy of the CAUV program, but all would prefer some more predictability in their values and more importantly, their tax bill.

Last year’s state budget, thanks to the work of Ohio Farm Bureau members, included the creation of a Property Tax Review Committee to take on the task of looking at long-term solutions for CAUV and residential property tax values. At issue are substantial increases in property taxes across the board, including the Current Agricultural Use Valuation Program.

In early February, Leah Curtis, policy counsel and senior director of member engagement for Ohio Farm Bureau, testified in front of the newly formed committee to offer some background on what CAUV is and how the increases coming this year will impact Ohio agriculture.

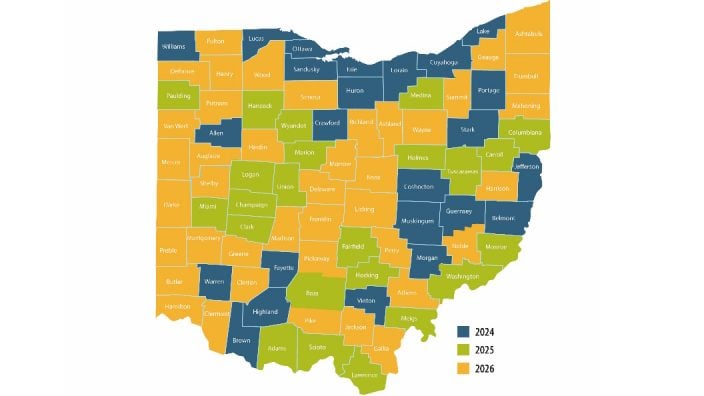

“Many property owners saw their property values increase in the most recent round of reappraisals and updates,” Curtis told the committee. “You have heard of 40 or 50% increases in residential home values, but CAUV landowners in 41 counties saw their property values double or more in this last reappraisal cycle. While almost unheard of in residential or commercial real estate, increases of this nature have not been uncommon for CAUV in the last 20 years.

While the formula does a good job of valuing farmland for productive potential, Curtis said that applying the current tax system to those values does result in a very high property tax burden. Additionally, the CAUV calculation was designed to follow a farm economy, but the farm economy of the 1970s is one that no longer exists.

“Instead, today’s farmers operate in a global marketplace, and we have an incredibly volatile farm economy where prices and costs can change dramatically not just from day to day but from minute to minute,” Curtis said, “Where the actions of a country halfway across the world will throw our industry into a tailspin in a moment’s notice.”

Curtis pointed out one flaw in the property tax system: CAUV values are based upon the farm economy that was a year and further back, but farmers pay taxes in the present. So by the time the tax bill comes due, the farm economy could be very different from the one the calculation considered. Additionally, because of the three-year cycle of updating values, the farm economy can change wildly from the time the values are calculated to the last year of those values’ application for tax purposes three years later. She shared that farmers are happy with the purpose and philosophy of the CAUV program, but all would prefer some more predictability in their values and more importantly, their tax bill.

“Ohio agriculture would not be the number one industry it is today in Ohio without the Current Agricultural Use Valuation program,” Curtis testified. “The unchecked urban sprawl of the 1970s would have continued, driving up farmland property values and pushing farmers off of their land through increases in property taxes. Instead, Ohio enjoys some of the best and most productive farmland in the country, if not the world. The food security provided by Ohio agriculture is not just good for farmers, or good for the economy, but is a matter of national security.”

As the Property Tax Review Committee continues its work to look for possible reforms to the system, Ohio Farm Bureau will continue to be heavily involved in the process to find a solution that will offer all property owners across Ohio a tax valuation system that is more clear and certain.

Watch Leah Curtis provide her testimony, via The Ohio Channel.

Leah Hetrick, from Ohio Farm Bureau, explained how CAUV works and how the equation used to determine property taxes works.

Read More

As Ohio Farm Bureau Policy Counsel Leah Curtis notes in this Legal with Leah, these changes should result in significant tax savings for many Ohio woodland owners.

Read More

CAUV 202 took a deeper dive into how tax bills are formulated and what exactly goes into the Current Agricultural Use Value numbers.

Read More

After years of advocacy from Ohio Farm Bureau and its partners, the Ohio Department of Taxation announced today that it will address inaccurate woodland calculations in the Current Agricultural Use Value program.

Read More

Taking a look at the history of CAUV can help with understanding its structure, fluidity and the eternal vigilance needed by Ohio Farm Bureau and our members for its sustainability.

Read More

Kelly Tennant’s story starts as many others in agriculture do, but her current day job impacts Ohio ag more than most.

Read More

Learn more about eligibility and how to include conservation practices on CAUV enrollment forms.

Read More

Bob and Polly Givens are on a mission to inform small landowners-homesteaders of the advantages of CAUV.

Read More

With the pressure on Ohio farms, perhaps the most important way farmers can afford to keep farming is with the protection of CAUV.

Read More

Mark DePugh was on the fence about renewing his CAUV enrollment, until he realized the amount of tax savings he would be missing.

Read More