Applications for Ohio Farm Bureau Health Plans now available

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read MoreOhio farmland tax valuations continue to decline across the state according to a new study from Ohio State University. The study shows tax valuations have dropped by one third since the Current Agricultural Use Value formula was changed by the state legislature in 2017. Ohio Farm Bureau led the effort to make valuations more reflective of current farm economic factors.

Before the formula change, the average tax valuation of land in Ohio was $1,310 per acre. After the change, the average valuation was $875 per acre, according to the study done by agricultural economists Robert Dinterman and Ani Katchova with OSU’s College of Food, Agricultural, and Environmental Sciences.

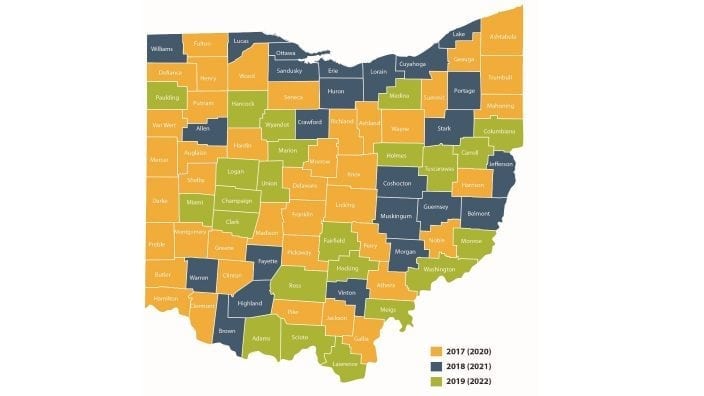

Agricultural land values and the corresponding taxes paid on that land will continue to decline at an even faster rate, Dinterman said. Steeper decreases in taxes will be seen, on average, because the changes to the way the farmland is assessed have been phased in between 2017 and 2019. Small changes were made each year to avoid a sudden and dramatic drop in tax revenue, Dinterman said.

But in 2020, the phase-in will end, so Ohio farmland owners should see another one-third drop in the assessed value of their land, compared to the previous year, and similar declines in their taxes, Dinterman said.

The average tax paid across the state was about $36 per acre of farmland in 2016. That dropped to around $31 in 2017, Dinterman said. By 2020, the average likely will be around $25 per acre, which would match the rate paid in 2011, he said.

The legislative adjustment to the CAUV formula followed three years of grassroots efforts by Farm Bureau members who asked lawmakers to respond to dramatically higher farmland taxes at a time when the farm economy was slumping.

“Ensuring that farmers have accurate property tax values is integral to preserving farmland in our state,” said Ohio Farm Bureau Policy Counsel Leah Curtis.

Another Farm Bureau promoted change is also paying off, she said.

“The penalty on farmers who place land in conservation practices has been eliminated,” Curtis said. “Conservation lands are now being taxed at a lower rate, which helps farmers continue their efforts to protect water quality.”

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read More

Members ages 18-34 who are interested in developing their leadership skills and enhancing programming for their peers should apply.

Read More

Senate Bill 328 is legislation designed to strengthen career-connected learning and better prepare students for Ohio’s workforce needs.

Read More

With the Family Forest Carbon Program, you can have a successful farm and get paid to grow healthy forests.

Read More

Ohio Farm Bureau recently sent a letter to Congress calling for the swift passage of the Farm, Food, and National Security Act of 2026 (HR 7567).

Read More

House Bill 646 would establish a Data Center Study Commission to examine the impact of rapid data center development across the state.

Read More

Collegiate Farm Bureau serves as a connection to current industry professionals and equips the next generation with the essential tools and resources needed to excel in their careers.

Read More

Ohio Farm Bureau members met one-on-one with state legislators and staff to discuss policy priorities impacting Ohio’s farms and rural communities.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More