A decade of action: Grain bin safety for 2026

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read MoreNationwide, the country’s leading insurer of farms and ranches, stands ready to help members prevent losses on their farms. Recently, Nationwide released its list of the top preventable insurance claims on farms and ranches in 2019. The following claim types accounted for more than 20,000 claims in 2019:

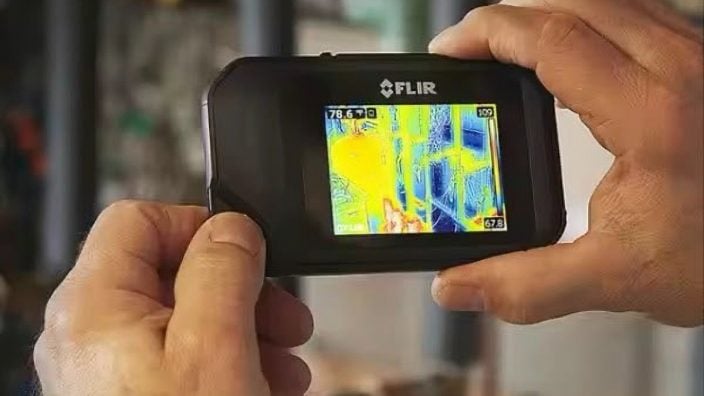

1: Fire To help prevent or reduce the impacts of fires, ensure working fire extinguishers are present in shop areas and on mobile equipment. You should also confirm that the appropriate electrical service is in place for the environment (grain bins, confinement, etc.) and have a licensed electrician inspect the system as updates are made. Make certain that flammables are stored properly, confirming fuel tanks are located away from structures, and implement regular maintenance and good housekeeping measures for properties and heating units.

2: Weather (wind, hail and lightning) When possible, verify that quality building materials are utilized during construction and that proper building maintenance is followed to keep properties in safe condition. To help prevent wind damage to structures, check that screws are used as opposed to nails for the roof and siding fasteners. Protect critical electrical components with lightning surge protection and make sure backup generators are on hand for power outages. Remember to also store equipment and vehicles under cover for protection from hail.

3: Roadway vehicle and mobile equipment accidents Accidents involving vehicles or mobile equipment tend to be severe losses. Prioritize the safety of drivers by implementing driver training and sharing rural road safety information. For mobile equipment, be sure maintenance is up-to-date, all operators are trained to use equipment properly and that safety features, such as lighting and SMV signs, are operational. Avoid moving machinery after dark when possible. It’s also helpful to plan routes in advance to anticipate any potential hazards you might encounter like bridge weight limits or slick roads.

4: Animal-caused damage Livestock operations often experience costly damages resulting from animals escaping and damaging property or being struck by vehicles. Verify that adequate fencing is in place and that it’s routinely inspected for damage, especially after storms or high wind events. Daily monitoring of livestock can also help identify potential problems.

5: Building collapse Building collapse-related claims commonly result from snow and ice buildup on structures, though they also occur with grain bins and other farm structures. To prevent unnecessary weight on structures, implement snow removal plans and be sure to target areas where snow and ice tend to build. You should also maintain the integrity of farm structures by conducting regular truss inspections, including inspections of nail plates and truss bracing, in addition to following proper building maintenance practices. For grain storage structures, make certain that proper grain storage and loading/unloading practices are followed.

6: Workplace and on-premises injuries Workplace training is critical to ensure the safety of workers and products while protecting your operation from costly interruptions. Confirm training is comprehensive and that adequate safeguards, like machine guarding, spotters and up-to-date equipment maintenance, are in place. You should also communicate clearly with workers and have an emergency action plan that’s ready to be put to use in the event it’s needed. On-premises injuries are of particular concern in agritourism or other situations where people are invited onto the farm. Housekeeping is very important; make sure walkways are even, clear and free from slip/trip hazards. You can also consider limiting public access to hazardous areas.

7: Theft Even in rural communities, theft of property, mobile equipment and motor vehicles can be relatively common. Restrict public access to properties with locks and gates and use security lighting and camera systems to scare away bad actors. It’s also helpful to park equipment out of easy view and remove the keys to any vehicles.

8: Food safety More and more farm operations are becoming intimately involved in food production as a way to supplement income or create a direct relationship with customers. As with other areas of agriculture, food safety requires strict adherence to training and sanitation precautions. You should also be strict with housekeeping practices to reduce clutter and the chance for contamination. Equipment maintenance is also important to ensure good working order and appropriate cleaning.

Nationwide’s risk management team serves members by helping them recognize areas of their operation where they may need to take extra measures to keep their employees, products and equipment safe. To learn about Nationwide’s risk management services or get started with a farm review for your operation, visit nationwide.com/agribusiness.

About Nationwide

Nationwide, a Fortune 100 company based in Columbus, Ohio, is one of the largest and strongest diversified insurance and financial services organizations in the United States. Nationwide is rated A+ by both A.M. Best and Standard & Poors. An industry leader in driving customer-focused innovation, Nationwide provides a full range of insurance and financial services products including auto, business, homeowners, farm and life insurance; public and private sector retirement plans, annuities and mutual funds; excess & surplus, specialty and surety; pet, motorcycle and boat insurance. For more information, visit nationwide.com.

1 Source: 2018 SNL Financial Report. Based on statutory data. The information included in this publication and accompanying materials was obtained from sources believed to be reliable. Nationwide Mutual Insurance Company and its employees make no guarantee of results and assume no liability in connection with any training, materials, suggestions or information provided. It is the user’s responsibility to confirm compliance with any applicable local, state or federal regulations. Information obtained from or via Nationwide Mutual Insurance Company should not be used as the basis for legal advice or other advice, but should be confirmed with alternative sources.

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

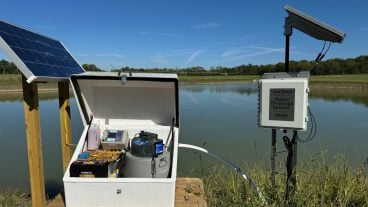

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More

Learn more about the Health Benefits Plan as well as new options coming for farm families, plus, get propane handling safety tips from Nationwide.

Read More

By understanding the dangers and taking these precautions, farmers can safely harness the power of propane.

Read More

Ohio Farm Bureau’s Heritage Partner Nationwide teams up with leading agtech companies to offer innovative protection solutions that can help reduce losses and boost productivity.

Read More