A decade of action: Grain bin safety for 2026

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read MoreConsult with your farm’s team of trusted advisers in drafting your next farm lease. That includes your lender, accountant, attorney and insurance provider.

A handshake seals the deal. That’s been true for farmland leases for generations. But the market’s changing. So is the need to get that deal down in writing.

Growing competition and high costs make it important to sign a written lease that spells out the responsibilities of both farmland owner and lessee. Doing so cements a strong relationship between both farmland owners and lessees, and that has long-term benefits for the land’s productivity.

A written farm lease is a contract that transfers to a lessee the right to use a property for a specified purpose in a defined time frame. It includes key details to both farmland owner and lessee. Farmland leases are renewed at the same time each year. In the Midwest, it typically happens in the fall and runs through the following year’s crop growing season.

A written, signed lease is like an insurance policy for farmland for a specified time frame. With a long-term lease in hand, a lessee has the assurance that he or she can reap the rewards of a shared investment to make improvements. With a multi-year lease, the lessee has assurance he or she will be working on that land well into the future. That makes it easier to justify improvements over time, especially when the landowner shares those costs.

The farmland owner reaps similar benefits from a long-term written farm lease. Such an agreement enables the owner to work with his or her lessee to make improvements over time. This ultimately sustains or improves the land’s productivity, making it more valuable in the long run. A written lease also helps manage risk for the landowner. Contractual risk transfer is a critical function of a written farm lease.

The duration and price paid by the lessee are foundational to every lease. Also include:

Lease structure. Cash rent has historically been the most common agreement, especially with absentee landowners. Crop share is another type that is popular among landowners — like retired farmers — who want to remain more engaged in decision-making on things like crops planted, agronomic management and long-term improvements like drainage tile installation.

Full terms. It’s important to not just spell out the specific lease termination date, but also how that termination will happen whether because of the contract reaching maturity or one party failing to meet his or her obligations.

Land use. Most farmland leases are signed for crop production. But there are other uses of the land that should be spelled out whenever relevant. Consider accounting for things like livestock grazing, hunting and energy generation — wind, solar or oil/natural gas — in writing a land lease if they are potential future land use options.

Farmland rental rates vary from region to region, and even county to county, based on the supply and demand for farmland. Rates can also vary depending on the type of farming being proposed on the land. There are many considerations when it comes to rental rates, including:

As you structure your next farm lease, remember no two farms are exactly alike. It’s a good practice to account for all specific variables that could influence each lease’s liabilities for both landowner and lessee before signing. Consult with your farm’s team of trusted advisers in drafting your next farm lease. That includes your lender, accountant, attorney and insurance provider.

A well-designed and planned-out farmland lease can help ensure the productivity of farmland well into the future.

Under HB 397 passed in 2021, notice must be given by Sept. 1 to terminate a farm lease, and the lease will terminate at the conclusion of harvest or Dec. 31, whichever comes first.

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

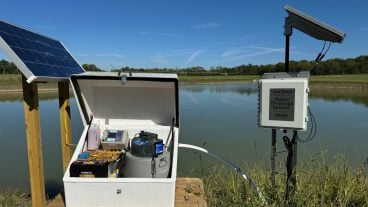

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More

Learn more about the Health Benefits Plan as well as new options coming for farm families, plus, get propane handling safety tips from Nationwide.

Read More

By understanding the dangers and taking these precautions, farmers can safely harness the power of propane.

Read More

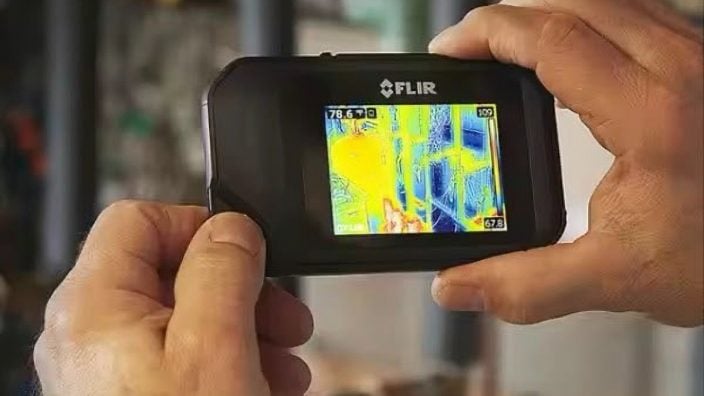

Ohio Farm Bureau’s Heritage Partner Nationwide teams up with leading agtech companies to offer innovative protection solutions that can help reduce losses and boost productivity.

Read More