Ohio Farm Bureau Podcast: The Cost of Thanksgiving and New Health Plans

Hear the results of Farm Bureau’s Thanksgiving Survey and the latest on Ohio Farm Bureau Health Plans.

Read MoreTrevor Kirkpatrick heard the stories for years.

As a former Farm Bureau organization director in eastern Ohio, Kirkpatrick had often been told how difficult it was for a family to farm full time if access to affordable health care was only possible with someone in the family having an off-farm, full-time job.

“I constantly heard of members who are in desperate need of health care. I know one family specifically that runs a beef and row crop operation that has four children. The dad works on the farm full time, the kids are active in sports and other activities, and the wife is needed on the farm as well,” Kirkpatrick said. “However, she is actively looking for a job off the farm just so that they can have health coverage for their family. They have stressed to me how they are concerned that her not being on the farm will force them to cut back on their operation just because of the lack of workforce to keep it running.”

It is precisely a family in that situation who will benefit greatly from the soon-to-be launched Ohio Farm Bureau Health Plans.

“Ohio Farm Bureau Health Plans will be a perfect option for them to have affordable, quality health care that is from a name they trust that will keep the family on the farm doing what they do best,” said Kirkpatrick, who is now director of health services for Ohio Farm Bureau.

After hearing similar stories from members who were looking for an affordable solution to their health care needs, Ohio Farm Bureau advocated for legislation to make the solution a reality.

“With health care costs continuing to rise, many Ohio farm families are having a hard time finding affordable, high-quality coverage, so they asked Ohio Farm Bureau for a better way and this is it,” said Bill Patterson, president of Ohio Farm Bureau. “Ohio Farm Bureau Health Plans will provide quality options at competitive rates, meaning that the peace of mind of health care coverage is no longer out of reach for our members.”

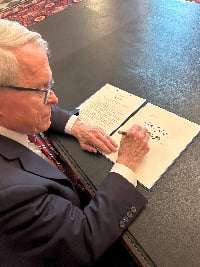

Gov. Mike DeWine signed SB 100 into law July 1, resulting in the creation of Farm Bureau Health Plans, giving access to affordable, personalized health care plans for Ohio farm families.

SB 100, introduced by Sen. Susan Manchester (R-Lakeview), and supported by Rep. Bob Peterson (R-Sabina), will help provide health care opportunities, close the gap in health care coverage and improve the well-being of current Ohio Farm Bureau members.

Farm Bureau Health Plans, which will serve as a member benefit similar to health plans offered by a number of other state Farm Bureaus across the country, will be in addition to the Ohio Farm Bureau Health Benefits Plan, which already offers small businesses health care plans for their employees.

Ohio Farm Bureau is partnering with Tennessee Farm Bureau, which is the flagship state for Farm Bureau Health Plans. Tennessee Farm Bureau already works with several other state Farm Bureaus offering similar health plans. As with so many Farm Bureau initiatives, it evolved out of a demonstrated need voiced by members.

“Farm Bureau populations are remarkably similar,” said Ben Sanders, executive director of government affairs at Farm Bureau Health Plans. “Coverage needed in Ohio, is needed in Texas, is needed in other states. Farmers and farm families need coverage. Most of those states have contracted with Tennessee for Farm Bureau Health Plans.”

Tennessee Farm Bureau has offered health plans to its members since 1947, and it was a game-changer from the get-go. Sanders, who comes from a full-time farming family in the Volunteer State, has felt the impact his entire life.

“My dad was a full-time farmer,” Sanders said. “I never experienced growing up with a lack of health coverage. I never had to worry about it. Families I knew grew up with this. They farmed full time – friends, family, neighbors – they never had to worry about it.”

The program has evolved over time. Sanders noted that, similar to Ohio’s recently passed law, Tennessee’s state statute passed in 1993 to answer some regulatory questions; there were no other membership associations providing a self-funded health plan, hence the need for regulatory clarity. The rationale at the time was that as a self-funded, self-governed membership organization, Farm Bureau should be afforded the same flexibility as any other self-insured group like employer plans.

“It was the first of its kind in Tennessee, and is in many other states,” Sanders said.

Ohio’s legislation takes effect Sept. 30, and Ohio Farm Bureau is currently working to establish a smooth enrollment period for members that will open later this fall, Kirkpatrick said. Any new enrollments this fall will be effective in January 2026.

With the successful passage of SB100, Ohio Farm Bureau will be able to offer these medically underwritten plans to individuals and families, at a significant savings over comparable Affordable Care Act plans.

Ohio Farm Bureau will be partnering with a subsidiary of Tennessee Farm Bureau to offer these plans through United Healthcare’s network.

“We rent United Healthcare’s provider network. They do the mechanics of it more efficiently than we do,” Sanders said. “Farm Bureau has a dedicated claims service in Cincinnati, Ohio.”

Sanders said he is often asked about Farm Bureau Health Plans impact on the Affordable Care Act market. They are two different things, he said.

“The Affordable Care Act of 2010 is applied to licensed insurance companies, which we aren’t,” Sanders said. “We have rates based on risk. But, we were never anti-ACA. We are a complement to the ACA market. We fill one of those specific gaps.”

Education about what the health plans are, and aren’t, is important, Sanders said.

“We give people coverage and look to make it affordable,” he said.

The plans are medically underwritten, said Michael Bailey, Ohio Farm Bureau senior vice president, operations & partnerships. “Just like when I purchase life insurance, the premium that I’m asked to pay and the type of coverage for which I’m eligible are both a function of my individual health.”

Sanders noted that the acceptance rate into Farm Bureau Health Plans is 85-90%.

“Applicants are offered coverage after a rating through underwriting,” Sanders said. “Rates

can vary.”

Specific details from Ohio Farm Bureau about Farm Bureau Health Plans will be available this fall, Kirkpatrick said (see FAQ).

Sanders noted that success in farming is dependent on hundreds of thousands of factors, and health coverage is one of those factors.

“Farm Bureau Health Plans gives a farming family the freedom of choice,” he said. “So many farmers have an off-farm job just to get the health benefits, and this gives them the option of not having to do it anymore just for the sake of the health insurance.”

For his part, Kirkpatrick can’t wait to hear success stories from members.

“We have heard many amazing stories from other states, whether that be about the quality of care they received, or simply how much money they saved in premiums. I want that for Ohioans.”

When can I purchase the plans?

Ohio Farm Bureau staff and agents across the state are working hard to be able to sell these plans in the fall. This will make the policies effective Jan. 1, 2026.

How can I purchase the plans?

Members will soon be able to apply for coverage by contacting an agent, through a dedicated website or calling an 800 number.

Editor’s Note: Ohio Farm Bureau Health Plans are open for enrollment. Visit the website to see plan options and to apply.

KEY POINTS

Learn more about Ohio Farm Bureau Health Plans at an upcoming webinar. (Each webinar will consist of the same content.) Billy Fields, director of state alliance operations at Farm Bureau Health Plans, will give more context to the plans and answer any questions. All webinars begin at 6 p.m. and will last one hour. Register for the webinars using the following links:

Questions about health plans to be answered on the webinar may be submitted ahead of time.

Disclaimer: Ohio Farm Bureau Health Plans are not insurance and are not regulated as insurance under Ohio law.

Hear the results of Farm Bureau’s Thanksgiving Survey and the latest on Ohio Farm Bureau Health Plans.

Read More

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read More

Join us Sept. 24 to receive the tools, resources and confidence you need to strengthen your health and financial future.

Read More

The goal of these informational sessions is to allow members to learn about the forthcoming health plans and how they and their families can utilize them.

Read More

Ohio Farm Bureau Health Plans are available for enrollment.

Read More

Ohio Farm Bureau is pursuing an option that would provide a competitive and innovative alternative for members who do not easily fit into traditional health plan coverage.

Read More

The goal will be for members to have access to these new health plan options as early as January 2026.

Read More

Farm Bureau Health Plans would give access to affordable, personalized health care plans for Ohio farm families.

Read More

Plans would be for Ohio farm families who do not have access to health insurance as an employee benefit or who are uninsured or underinsured due to high costs and limited options in the marketplace.

Read More

Farmers’ physical and mental health are often compromised by lack of health coverage. Farm Bureau seeks to establish Farm Bureau Health Plans.

Read More