Property tax policy under discussion

OFBF annual meeting delegates will discuss how or if current Farm Bureau policy should be modified in light of various property tax proposals.

Read MoreFarm Bureau's role in supporting the agricultural community is crucial, especially during times of significant change and uncertainty.

The Adams, Brown, Clermont, and Highland County Farm Bureaus held a members-only Current Agricultural Use Value Informational Session on Saturday, June 8 at 9 a.m.. A total of 45 local members attended the session, representing all four counties.

The CAUV program, passed in 1973 and implemented in 1975, is designed to tax farmland based on its agricultural value rather than its market value. This approach aims to ease the tax burden on farmers, preserving farmland by making it more affordable to maintain. However, the recent reappraisal and update in 2023 have caused CAUV values to surge significantly, impacting farmers with increased property tax bills.

Leah Curtis, policy counsel and senior director of member engagement with the Ohio Farm Bureau, was the session’s keynote speaker. She provided a detailed overview of the factors contributing to the recent increases in CAUV values. Curtis also offered insights into the property tax system and updated attendees on legislative actions that could affect future CAUV calculations and tax assessments.

Several factors are driving the substantial increase in CAUV values, with some counties reporting hikes between 80% and 100%. Key reasons include commodity prices, interest rates, soil productivity data and market trends.

For those not currently members, the session highlighted the numerous advantages of joining Farm Bureau:

Farm Bureau’s role in supporting the agricultural community is crucial, especially during times of significant change and uncertainty. The recent CAUV informational session is a prime example of the valuable support and insights available to members.

For more information about joining Farm Bureau and the benefits it offers, visit the Farm Bureau website or contact your local county office.

OFBF annual meeting delegates will discuss how or if current Farm Bureau policy should be modified in light of various property tax proposals.

Read More

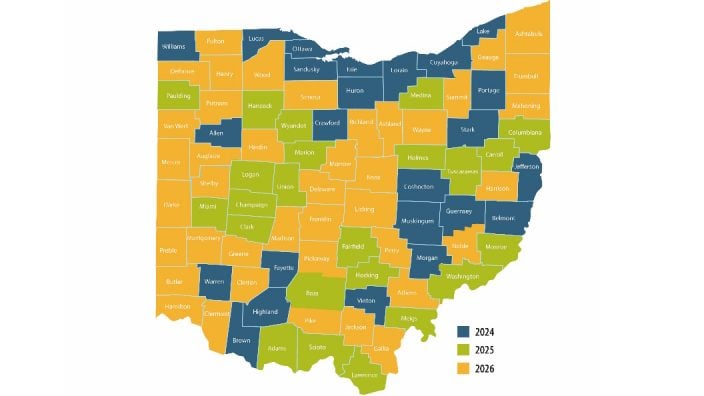

In 2025, about 21 counties are going through a reappraisal or update, and because Ohioans pay taxes one year behind, they will see new property tax bills in January 2026.

Read More

Overall, proper care, maintenance and communication are all essential parts of the process when it comes to trees.

Read More

This will apply to the 23 counties on the revaluation cycle in 2025, who will see updated values and tax bills in January 2026.

Read More

‘We never stop pushing to ensure farmland taxation is fair and reflects the realities of agriculture.’ ~ Mandy Orahood

Read More

In this recording, learn about the recent increases in Ohio CAUV values, gather information to help you understand the property tax system, and get an update on legislative action.

Read More

Join us for an informative session March 8. Experts will explain recent changes, answer your questions, and help you better understand how CAUV impacts you.

Read More

Lorain County Farm Bureau hosted a CAUV meeting Jan. 30, 2025 at LCCC Wellington Center presented by the Lorain County Auditor’s Office and Lorain County Farm Bureau.

Read More

Join Ohio Farm Bureau for a free webinar Feb. 11 to discuss the recent increases in CAUV values, Registration is required.

Read More

Join us Jan. 30 for a CAUV Overview Meeting at Lorain County Community College.

Read More