At Nationwide, our past informs our future

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read MoreAccording to Agent Ty Kellogg, an insurance relationship starts with a genuine interest in the other person and the ability to listen and really understand some of the greater concerns related to coverage.

When things don’t go the way they should on the farm, it is not unusual for people in the community to stop and see if there is anything they can do to help. For Ashtabula County Farm Bureau member George Colucci, who has had a couple of unfortunate circumstances over the past several years, one of the people always there to help has been his insurance agent.

“A year or two after I switched to Nationwide, I was in my RoGator self-propelled sprayer and all of the sudden I saw a tire flying by me after the wheel motor failed,” Colucci recalled. “A day after I called my agent, the adjuster, knowing how important the timing of field applications are, called me the next day and offered to get a sprayer out to me. I had already spent $16,000 for parts and repairs, which he told me my policy would cover, so I was back in the field in a matter of days.”

Colucci farms close to 600 acres in northeast Ohio and works a full-time job off of the farm as a welder for Lincoln Electric, so any down time during the busiest parts of the year can set him back immensely. Another one of those occurrences happened this past summer when Colucci and his son were hauling fertilizer from a retailer in Alliance and a front steer tire blew out on his 15-ton truck, ripping the hood off and veering Colucci and his load of fertilizer off the road and into the ditch.

After the situation was assessed, realizing he and his son were alright, Colucci called the authorities and his family, then made a call to his agent, Ty Kellogg with Sherman Insurance Group, an Ohio Farm Bureau Select Partner.

This claim would be a little more complex, as it included covering the damaged truck and the cost to clean up what fertilizer had been lost in the accident. It also covered the cost of the fertilizer itself, which had been deemed unusable due to weather impacts after not being able to be stored away.

“The best insurance is not having to use any of it, but when I did need them, Nationwide has always been there and they truly understand the nuances of farming,” Colucci said.

According to Kellogg, any relationship starts with a genuine interest in the other person and the ability to listen and really understand some of the greater concerns related to coverage.

“When I speak with a farmer for the first time, very rarely do we talk about insurance. Instead, we are exchanging family histories and farm stories, shared connections and future farming plans,” Kellogg said. “With each interaction, I hope that farmers and their families understand that the insurance proposal is deeper than just liability, equipment and buildings – it is a critical protection tool for the present risks, but also a mechanism to ensure the farm has a chance to make it to the next generation.”

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

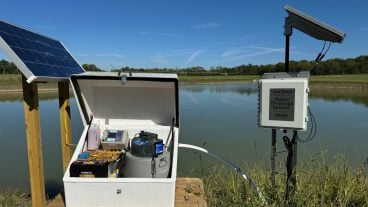

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More