Applications for Ohio Farm Bureau Health Plans now available

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read MoreProposed legislation in Congress would eliminate stepped-up basis and tax capital gains at death as ways to raise revenue for government spending. These changes would have a major impact on family farms throughout Ohio and across the country. For this Legal with Leah, Ty Higgins discussed the implications of these changes in the tax code with Ohio Farm Bureau Policy Counsel Leah Curtis and shares information about a Farm Bureau Action Alert for members to share how these changes would affect their livelihoods.

Listen to Legal with Leah, a podcast featuring Ohio Farm Bureau’s Policy Counsel Leah Curtis discussing topics impacting farmers and landowners.

Ty Higgins [00:00:00] Proposed legislation in Congress would eliminate stepped-up basis and tax capital gains at death as ways to raise revenue for government spending. These changes would have a major impact on family farms throughout Ohio and across the country. For this Legal with Leah, we’ll discuss the implications of these changes in the tax code with Ohio Farm Bureau’s Policy Counsel Leah Curtis. But first, Leah, let’s start by explaining what capital gains taxes are and what they do.

Leah Curtis [00:00:24] So capital gains taxes are taxes that are paid when you sell certain assets, and the tax is applied to the difference in value from when you got the asset to when you sold it. And the rate is going to vary based on what the asset is and how long you held it. But for simple example, let’s say you buy an acre of ground that’s $5,000, and then 10 years later you sell it and when you sell it, you sell it for $10,000. The capital gain there is the $5,000 difference in value from when you bought it, to when you sold it. And then of course, considering any exemptions and what the tax code is at the time and how it all fits into your larger tax picture, a capital gains tax might apply to that $5,000 increase in value.

Ty Higgins [00:01:06] There’s one component of capital gains tax that we really have our eye on in agriculture, and that’s called stepped-up basis. Why are we watching that and why is it so important to agriculture?

Leah Curtis [00:01:18] So stepped-up basis has been around for a long time and it’s really important when we talk about capital gains when assets are inherited. So stepped-up basis says if you inherit an asset, you get to step-up its value to the current day market value without paying any capital gains taxes, and that’s when it’s inherited. So in our example, if your parents bought that ground for $5,000 an acre and then 10 years later you inherit it and it’s now worth $10,000, when that land passes to you through a will or trust or some some sort of mechanism, that value gets stepped up. And so now it’s sort of like we start over and if you would sell it in the future, we would only look to that $10,000 value instead of looking all the way back to when your parents bought it at $5,000.

Ty Higgins [00:02:01] So there’s some changes being proposed in Washington. We’re hearing a lot about taxes. We’re hearing a lot about big corporations being taxed and how families aren’t going to be impacted. Agriculture’s a little bit different in this space. We talk a lot about being land rich and cash poor in farming. So what do these current proposals to eliminate stepped-up basis mean for our members?

Leah Curtis [00:02:27] So one of the proposals that’s sort of circulating out there is that these capital gains taxes would be paid upon death. So instead of having that step up at death and not having any taxes, there would be some capital gains at the time that that asset was going to be passed on. And that is a big deal for agriculture, of course, because a lot of our assets are held for very long times and then inherited or passed along, as opposed to other businesses where things may be sold or held in much shorter time frames and not go through that same kind of process.

And of course, as family farms, that continuity of assets is really important, and our assets in agriculture are not liquid. We’re not talking about stocks and bonds. We’re talking about combines and grass, and hay fields and corn fields. So it’s not as easy to liquidate and not have an impact on the business, whereas some other larger businesses might be able to do that a little more flexibly than we can. Would you want to make sure we point out that there are there’s not many details yet, but there has been an announcement that there will be some proposed exemptions that apply specifically to farms in agriculture. So we are waiting on details, of course, and need to see those details to really fully understand what this will look like in the future.

Ty Higgins [00:03:46] You mentioned we don’t know a lot, but we also need to be out front of this. And that’s why Farm Bureau at the federal and state level have issued Action Alerts to get our members to get in touch with their congressmen and women inside the Beltway to talk about why eliminating stepped-up basis would be so detrimental to family farms across the state and across the country. What have we done at Ohio Farm Bureau internally to reach out to those members of Congress?

Leah Curtis [00:04:12] So, of course, our own lobbyist staff is working with our members of Congress to discuss these issues. And then President Patterson as well, recently sent a letter to our entire congressional delegation outlining some of the concerns and the issues that these basic proposals that have been out there without a lot of details could mean for agriculture and for family farms here in Ohio. And then we also, of course, we always want to ask our members to tell their story. And that really is what makes a big impact. And so we have an Action Alert out for our members to just let their congressional representatives know, their senators know how important this is to your farm and how it would look on your farm if this was taken away, what that impact would have maybe on your kids or your grandkids as we try to continue that family farm business.

Ty Higgins [00:04:59] You can find a direct link to that action alert in the description of this Legal with Leah and of course, online. Leah Curtis, policy counsel with Ohio Farm Bureau, our guest for Legal with Leah. I’m Ty Higgins. We’ll see you down the road.

Protect stepped-up basis for American family farms! Action Alert

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read More

Ohio Farm Bureau members met one-on-one with state legislators and staff to discuss policy priorities impacting Ohio’s farms and rural communities.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

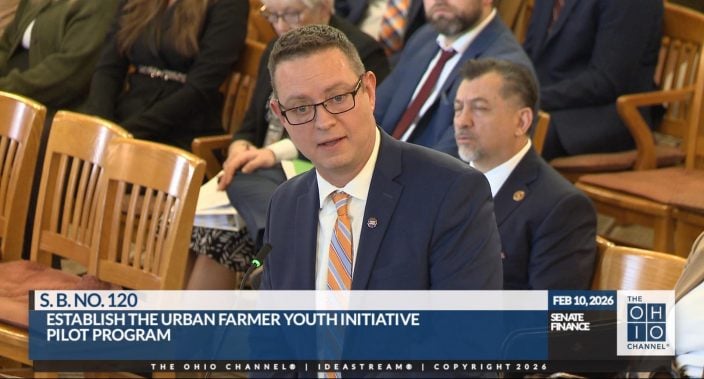

Introduced by Sen. Paula Hicks-Hudson, SB 120 would establish the Urban Farmer Youth Initiative Pilot Program.

Read More

Gases, vapors, and fumes can all create risk. How can we measure and protect ourselves from them?

Read More

The Ohio Farm Bureau’s Young Agricultural Professionals State Committee has named its 2026 leadership and the individuals who will be serving on the state committee for 2026-2028.

Read More

The Ohio Farm Bureau Foundation has multiple scholarships available to Ohio students from rural, suburban and urban communities who are pursuing degrees with a connection to the agricultural industry.

Read More

With 100% bonus depreciation now permanent, farmers can deduct the full cost of a new agricultural building in the year it’s placed in service.

Read More

Lincoln Deitrick was named the Outstanding Young Farmer, Denver Davis won the Excellence in Agriculture Award, and Margaret Houts won the Discussion Meet.

Read More