Applications for Ohio Farm Bureau Health Plans now available

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read MoreThanks to the perseverance of our members and diligent work of Farm Bureau staff, Current Agricultural Use Value reform was made law by the passage of the state budget this summer.

“This outcome was the result of a concerted, three-year effort of lobbying the tax department, legislature and administration,” said Ohio Farm Bureau Executive Vice President Adam Sharp, noting that thousands of phone calls, visits, emails and letters from members from across the state telling their elected officials that CAUV needed to be addressed made a huge impact.

And not a moment too soon.

Statewide, Ohio farmers saw a 307 percent increase in property taxes charged between 2008 and 2014. Those higher taxes were being paid at a time when some farm crop prices had fallen as much as 50 percent and a formula that had worked well for decades started to falter.

“We had the perfect storm,” said Leah Curtis, Ohio Farm Bureau policy counsel. “We had interest rates being held down on a federal level, while we had higher farm prices in the calculation from a few good years and residential values were going down.”

It was at this time that the tax bills for farmland owners were coming due.

“The formula was becoming disconnected from the farm economy,”

Curtis said.

Ohio Farm Bureau took aggressive action starting three years ago to address the CAUV calculations that were drastically increasing some property tax bills for farmland owners. In June, that work got results when Farm Bureau members worked together to reform CAUV property taxes through legislative action.

“It wasn’t easy,” said Yvonne Lesicko, OFBF vice president of public policy. “This was a monumental effort of the entire organization. There were opponents who resisted our every move, but in the end the power of Farm Bureau to organize members and tell their stories directly to lawmakers won the day.”

The reform legislation signed into law by Gov. John Kasich ensured several changes affecting the formula:

• Financial market data used in the calculation is now tied to the farm economy and what happens on

farms, rather than the general financial markets;

• An increase in holding assumptions from five years to 25 years, as most farms are passed down in a family and are owned and operated for more than five years;

• Equity assumptions, previously based on the general federal

interest rate, will now be based on farm-specific equity data from the United States Department of Agriculture; and

• CAUV land used for year-round conservation practices or enrolled in a federal land retirement or conservation program for at least three years, will now be valued at the lowest of the values assigned on the basis of soil type.

The conservation provision was as key as any other provision in the formula, according to Jenna Beadle, OFBF director of state policy.

“Working to remove the tax penalty for placing land in conservation was important for our members,” Beadle said. “Farmers are trying to do the right thing and our tax policy should be supportive of their efforts.”

It is estimated that these new changes, coupled with previous Farm Bureau-led reforms, will result in average savings of 30 percent for 2017 reassessments. The reforms are phased-in over two reassessment cycles – six years – in order to assist local communities and schools as they transition to the more accurate CAUV formula.

“Going forward we’re going to have a CAUV calculation that’s more accurate and more directly related to the farm economy,” Curtis said.

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

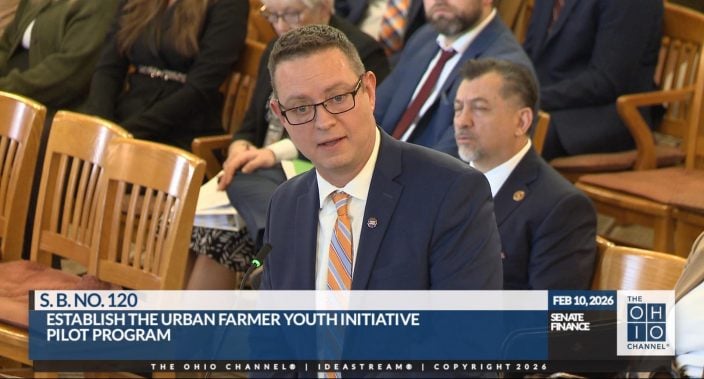

Introduced by Sen. Paula Hicks-Hudson, SB 120 would establish the Urban Farmer Youth Initiative Pilot Program.

Read More

Gases, vapors, and fumes can all create risk. How can we measure and protect ourselves from them?

Read More

The Ohio Farm Bureau’s Young Agricultural Professionals State Committee has named its 2026 leadership and the individuals who will be serving on the state committee for 2026-2028.

Read More

The Ohio Farm Bureau Foundation has multiple scholarships available to Ohio students from rural, suburban and urban communities who are pursuing degrees with a connection to the agricultural industry.

Read More

With 100% bonus depreciation now permanent, farmers can deduct the full cost of a new agricultural building in the year it’s placed in service.

Read More

Lincoln Deitrick was named the Outstanding Young Farmer, Denver Davis won the Excellence in Agriculture Award, and Margaret Houts won the Discussion Meet.

Read More

Michelle Downing of Franklin County has been named finance director of county operations for Ohio Farm Bureau.

Read More