Across the Table: The most important conversation

What does the future of the farm look like when the older generation is no longer a part of what happens day to day?

Read MoreAlisha Morgan is passionate about succession planning because without that plan in place, the emotional and financial tolls that came their family’s way could have resulted in the loss of their farm.

Alisha Morgan didn’t grow up thinking she’d fall in love with Jersey dairy cows, but the Indian Lake native is very protective and proud of her favorite girls.

“I thought I was only going to have dogs and cats while I was growing up,” she said. “But now I can say all my large brown furry friends are what I probably love the most. I am a Jersey girl. Like, I get angry every time we bring home a Holstein. I say we’re Morgan’s Jerseys not Morgan’s Holsteins!”

Morgan’s Jerseys breeds about 50 cows/heifers that are shown throughout the state, nation and even world dairy expos for their pedigree. They also have a grain and hay operation, the hay mostly for the cows, she said.

The future farm girl met her husband, Clark Morgan, in college and soon found herself swept up in a farming way of life she thoroughly enjoyed and wanted to help find a

way to protect.

The Champaign County Farm Bureau member has worked for Nationwide for 15 years, 13 years in claims and presently as an agribusiness underwriting territory manager for Ohio, West Virginia, Indiana, Illinois and Michigan. While her off-the-farm job has provided her and Clark, and their son, Jacob, with stability, it also served as an avenue to secure the future of the farm.

“A lot of farmers need to pay attention to what’s happening to your neighbors, what’s happening to your cousins and aunts and uncles,” Morgan said. “I think that people need to be aware of all of the things that mentally you think that you can’t lose. You really can lose them.”

Several years ago, the Morgans were seeing friends and neighbors lose or sell their farms for various reasons, including illness and family squabbles because of a lack of succession planning.

Morgan’s father-in-law, Jim, started thinking about coming up with a plan to pass on his operation in case of illness or death. With four kids and grandchildren in the mix, he knew a family meeting at the kitchen table that ended in a loose agreement between siblings might not be enough.

“My husband’s grandparents, my father-in-law, his parents who had the original farm died at a young age and pieces had to be picked up and nothing was planned,” she said. After attending a meeting about succession planning in their county, Morgan learned about her employer’s Land As Your Legacy program. It ended up being exactly what the Morgans needed – a structured plan that took into account what each person in the family had envisioned for their piece of the farm’s future before the business suddenly transferred from one generation to the next.

“Land As Your Legacy takes away all of that stress piece of all of the financials and the setting up for the future and knowing all of the steps, they do all of that for you and they take care of everything that you would have written down at the kitchen table,” she said.

The Morgans’ LAYL succession plan was finalized in 2014. Since that time, Morgan’s sister-in-law Karen passed unexpectedly, followed a few years later by her mother-in-law, also Karen, who had Alzheimers in the years following her daughter’s death.

Morgan is passionate about LAYL and succession planning because without that plan in place, the emotional and financial tolls that came their family’s way could have resulted in the loss of their farm.

“It’s hard to deal with all of these things while people are living and sitting in front of you, but at least mentally you know that it’s okay because it’s all taken care of,” she said. “You don’t have all of the back and forth headaches. When something happens to my father-in-law… I call a number and they do everything for us. They walk you through every single (step of the) process. The heartache is always going to be there, but at least there’s peace of mind.”

Nationwide’s Land As Your Legacy program has dedicated, experienced agents who are specifically trained at helping families make transitions to the next generation for the farm business.

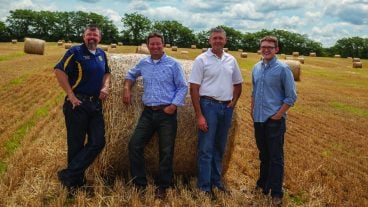

Eric Brown, a financial advisor specializing in Land As Your Legacy and a Farm Bureau member from Huron County, is an expert at the transition process, including some of the challenges he helps guide families through every day.

Eric Brown, a financial advisor specializing in Land As Your Legacy and a Farm Bureau member from Huron County, is an expert at the transition process, including some of the challenges he helps guide families through every day.

“Everyone thinks that money is the number one, most prevalent issue,” Brown said. “They think money is the issue, property is the issue, equipment is the issue, but the number one issue has always been a people issue.”

Families are all different, he said. Personalities can clash and long-held grievances can become large elephants in the room, especially when making plans for the future of the family farm takes center stage.

“It comes down to communication,” he said. “In the cases I’ve seen fall apart, the damage has been done because of a complete lack of communication. The longer that goes on, the more it will grow and fester and all of a sudden it’s this big deal.”

Five key elements make up the program – succession planning, business planning, risk management, financial independence and estate planning services. Land As Your Legacy agents can help families navigate all of them.

Brown said he has done everything, from being the objective third party at a family meeting to helping foster communication to going with farmers to meet with their attorneys and “speak lawyer,” to help them understand the complicated legalities of carrying on their legacy.

“I know the blood, sweat and tears that goes into getting a farm where it is today,” said Brown, who operates a 1,000-acre grain farm himself. “Why on earth would you leave (its legacy) to chance?”

Photos by Dave Gore

What does the future of the farm look like when the older generation is no longer a part of what happens day to day?

Read More

The Wetherell family is planning for the future of their farm while simultaneously making sure its current needs are met, with the help of Illumination Financial Group.

Read More

This collaborative approach is designed to draft personalized transition plans for farms, ensuring the seamless transfer of both business and familial responsibilities.

Read More

On this episode of Our Ohio Weekly: Farming is often a family run operation. As with any business, proper business…

Read More

The following information is provided by Nationwide, the No. 1 farm and ranch insurer in the United States. Farmers know…

Read More

Nationwide’s Land As Your Legacy program has dedicated, experienced agents who are specifically trained at helping families transition farm businesses…

Read More