Washington County Farm Bureau hosts CAUV meeting

Leah Hetrick, from Ohio Farm Bureau, explained how CAUV works and how the equation used to determine property taxes works.

Read MoreThe Statewide CAUV Update Webinar explained recent changes in CAUV and what could be next for the program. Watch the recording.

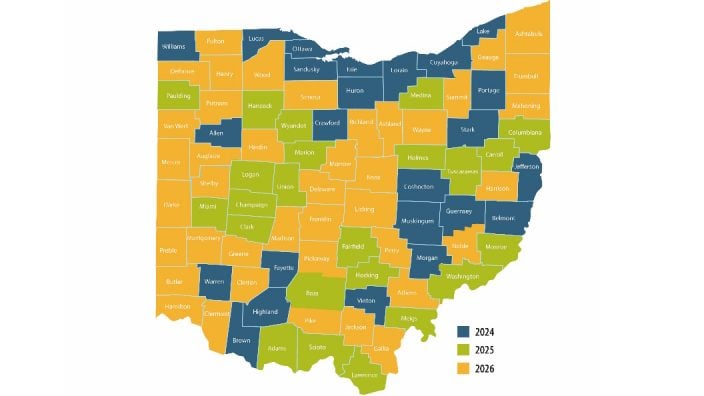

Current Agricultural Use Value has increased substantially following the 2023 reappraisal and update, affecting 41 counties that are seeing new tax bills this year. Some counties have reported CAUV increases between 80% to 100%.

Why are values increasing and how do property taxes respond? Join Ohio Farm Bureau for a free webinar March 5 at 9 a.m. to discuss the recent increases in CAUV values, information to help you understand the property tax system, and an update on legislative action.

Here is the recording of the webinar.

“After having some effects of a lower farm economy for a few years in the calculation, we’re now seeing impacts of a very strong economy,” said Ohio Farm Bureau Policy Counsel Leah Curtis, who will be presenting about the most recent CAUV news as part of the upcoming webinar. “Particularly those are strong crop prices and crop prices that were not only strong, but sustained over several years. Most of our data sets in the formula use seven years of data. So we’re looking at 2017 to 2023, and that has resulted in significant increases in the CAUV soil values.”

Curtis and her team have been working multiple channels to address concerns over CAUV increases, as well as some other CAUV issues, including a thorough review of the formula.

“We’re meeting with the tax department with those concerns, and the Legislature also recently passed the formation of a joint committee on property taxes,” Curtis said. “We intend to continue to be heavily engaged with that committee, and we will be advocating for our own policies not just on CAUV, but on property tax in general for our members through that committee process.”

Leah Hetrick, from Ohio Farm Bureau, explained how CAUV works and how the equation used to determine property taxes works.

Read More

As Ohio Farm Bureau Policy Counsel Leah Curtis notes in this Legal with Leah, these changes should result in significant tax savings for many Ohio woodland owners.

Read More

CAUV 202 took a deeper dive into how tax bills are formulated and what exactly goes into the Current Agricultural Use Value numbers.

Read More

After years of advocacy from Ohio Farm Bureau and its partners, the Ohio Department of Taxation announced today that it will address inaccurate woodland calculations in the Current Agricultural Use Value program.

Read More

Taking a look at the history of CAUV can help with understanding its structure, fluidity and the eternal vigilance needed by Ohio Farm Bureau and our members for its sustainability.

Read More

Kelly Tennant’s story starts as many others in agriculture do, but her current day job impacts Ohio ag more than most.

Read More

Learn more about eligibility and how to include conservation practices on CAUV enrollment forms.

Read More

Bob and Polly Givens are on a mission to inform small landowners-homesteaders of the advantages of CAUV.

Read More

With the pressure on Ohio farms, perhaps the most important way farmers can afford to keep farming is with the protection of CAUV.

Read More

Mark DePugh was on the fence about renewing his CAUV enrollment, until he realized the amount of tax savings he would be missing.

Read More