Demo farms project ends, impactful research endures

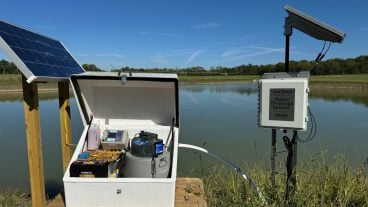

The network was established in fall 2015 on farms in Hardin and Hancock counties. Nearly 200 different tours and events took place on the three farms totaling nearly 4,000 visitors in its 10-year span.

Read More