Applications for Ohio Farm Bureau Health Plans now available

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read MoreMore than $300 billion has been added to the Paycheck Protection Program (PPP), after the initial $349 billion in funding was depleted in quick fashion earlier this month.

In a nutshell, PPP is designed to help small businesses keep their employees paid through the coronavirus crisis. These loans are open to many businesses under 500 employees, including nonprofits, the self-employed, startups and cooperatives.

Before the PPP, most farmers and ranchers had never worked with the Small Business Administration. Those in agriculture were most often referred to USDA’s Farm Service Agency.

When the program was finalized as part of the CARES Act, agriculture enterprises that meet the employment criteria, whose principal place of residence is in the United States became eligible, regardless of revenue levels.

“The results of our Farm, Food and Agribusiness COVID-19 Impact Survey made it very clear that many of our members were experiencing cash flow issues due to this crisis, so we made sure lawmakers knew the importance of reopening the PPP program,” said Jack Irvin, Ohio Farm Bureau’s senior director of state and national policy. “We encourage our members to look at this option, as well as the other programs included in the CARES Act as they seek assistance to help get them through these very difficult times.”

The PPP provides eligible businesses loans up to $10 million to cover 2.5 times the average monthly payroll costs, measured over the 12 months preceding the loan origination date, plus an additional 25% for nonpayroll costs. Payroll costs include salaries, commissions and tips; employee benefits (including health insurance premiums and retirement benefits); state and local taxes; and compensation to sole proprietors or independent contractors.

One of the real highlights of the PPP is that the portion of the loan that covers eligible expenses within an eight-week period from Feb. 15, 2020 – June 30, 2020, is forgivable, as long as the company maintains staff and payroll. Any loan proceeds in excess of this amount are subject to repayment at a rate of 1%. The maximum duration of the PPP loans is two years.

Funds from this program will be allocated to small businesses on a first-come, first-served basis. The sample application can help potential borrowers prepare for the lender meeting.

Farmers can apply for the PPP through any existing SBA 7(a) lenders, federally insured credit union, Farm Credit System institution or through any federally insured depository institution that is participating.

If Ohio Farm Bureau members are unable to be served by their local bank, Farm Bureau Bank is accepting applications from not only their existing customers, but from all Farm Bureau members as well. They have already assisted members in 26 states and have the capacity and expertise to help members in Ohio as well.

Other current eligible lenders can be found by searching the SBA website.

Find answers to frequently asked questions about PPP as it pertains to agriculture.

The U.S. Treasury Department and the Small Business Administration (SBA) released new guidance for calculating the maximum PPP loan, which includes guidance for farmers who file an IRS Schedule F. The updated guidance can be viewed here.

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

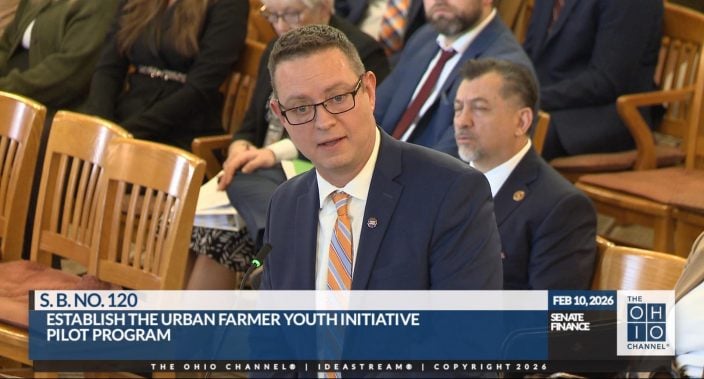

Introduced by Sen. Paula Hicks-Hudson, SB 120 would establish the Urban Farmer Youth Initiative Pilot Program.

Read More

Gases, vapors, and fumes can all create risk. How can we measure and protect ourselves from them?

Read More

The Ohio Farm Bureau’s Young Agricultural Professionals State Committee has named its 2026 leadership and the individuals who will be serving on the state committee for 2026-2028.

Read More

The Ohio Farm Bureau Foundation has multiple scholarships available to Ohio students from rural, suburban and urban communities who are pursuing degrees with a connection to the agricultural industry.

Read More

With 100% bonus depreciation now permanent, farmers can deduct the full cost of a new agricultural building in the year it’s placed in service.

Read More

Lincoln Deitrick was named the Outstanding Young Farmer, Denver Davis won the Excellence in Agriculture Award, and Margaret Houts won the Discussion Meet.

Read More

Michelle Downing of Franklin County has been named finance director of county operations for Ohio Farm Bureau.

Read More