Recent H-2A program impacts aim to steady farm labor costs, needs

A recent state budget fix and a federal rule reform to H-2A have resulted in some relief for farmers who use the guest worker program.

Read MoreWhen the Biden administration and members of Congress introduced new tax plans earlier this year, concerns arose about how some of the changes being proposed would impact family farms across Ohio and the country. In particular, Ohio Farm Bureau took issue with the possibility of eliminating stepped-up basis, which has created a significant tax break for those inheriting an asset such as farmland.

As talks of these modified tax ideas began to ramp up, Farm Bureau issued an Action Alert to its members, asking them to reach out directly to their representatives and share how the changes in stepped-up basis would impact their farm and families.

“I think that the message we have been sharing with lawmakers is being heard loud and clear,” said Brandon Kern, senior director of state and national policy with Ohio Farm Bureau. “Because of our members’ efforts, we have been able to keep these detrimental tax changes out of legislation in Congress.”

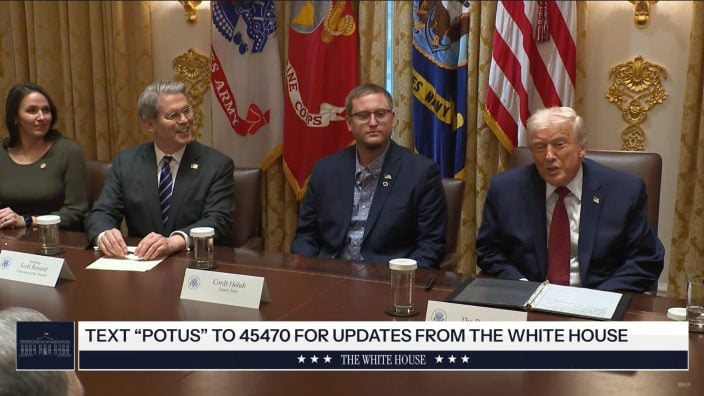

During September’s Ohio Farm Bureau Washington, D.C. Leadership Experience, taxes were one of the many issues heavily talked about, and lawmakers heard these points of concern in-person.

As a result, representatives on both sides of the aisle recently have spoken out against eliminating stepped-up basis, in particular.

“Ohio family farmers are a cornerstone of our economy and a pillar of our communities,” said Rep. Tim Ryan (OH-13) in a statement this week. “It is critical that Ohio’s family farms can continue to thrive from generation to generation without the fear of being hit with an unaffordable tax burden. That is why I applaud efforts to protect stepped-up basis within the Build Back Better Act, and I will continue to be a strong advocate to ensure this important measure for our family farmers is protected as Congress continues to debate this package.”

There are still some legislative opportunities that could add in the proposed tax changes that would greatly affect agriculture, so it is not too late to contact your member of Congress to voice your concerns.

“Stepped-up basis is still something Democrats would like to get rid of and that would be a huge problem,” said Sen. Rob Portman. “That would require a lot of farmers to have to sell property altogether just to pay the tax bill, and we can’t go back to that.”

Henry County Farm Bureau

Darke County Farm Bureau

Henry County

Trumbull County Farm Bureau

Sandusky County Farm Bureau

Farm manager, CSI Insurance

A recent state budget fix and a federal rule reform to H-2A have resulted in some relief for farmers who use the guest worker program.

Read More

Ohio Farm Bureau brought forth 10 policies to be voted upon by delegates at the American Farm Bureau Annual Convention in Anaheim earlier this week, and all 10 were approved as national policy.

Read More

Ohio EPA has recently proposed allowing data centers to obtain ‘general’ National Pollutant Discharge Elimination System (NPDES) permits for their stormwater/wastewater discharges.

Read More

Delegates discussed many topics impacting agriculture including farmland preservation, local foods, and succession planning.

Read More

Ohio Farm Bureau Treasurer Adele Flynn participated in the meeting, representing Ohio farmers.

Read More

HB 10 ensures transparency around how imitation meat is labeled, along with restoring needed flexibility around the application of crop protection tools.

Read More

The budget includes funding for: H2Ohio, animal health and animal disease response, the College of Veterinary Medicine at Ohio State, and the Brownfield Remediation Program.

Read More

The Pickaway County Farm Bureau Board of Trustees invites you to attend our Policy Development Breakfast at 8:30 a.m. on Wednesday, June 11, 2025.

Read More

The Fairfield County Farm Bureau Board of Trustees invites you to attend our Policy Development Breakfast at 8:30 a.m. on Tuesday, June 24, 2025.

Read More

Plans would be for Ohio farm families who do not have access to health insurance as an employee benefit or who are uninsured or underinsured due to high costs and limited options in the marketplace.

Read More