A decade of action: Grain bin safety for 2026

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read MoreThe following information is provided by Nationwide, the No.1 farm and ranch insurer in the U.S.*

Retirement isn’t often part of the long-term plan for farmers. But it’s still important to think about your long-term financial future. And a few retirement benefits are key components of that future.

That includes Social Security and Medicare. Incorporating these benefits into your long-term plans can help firm up your (and your farm’s) financial footing today and down the road.

“Farmers need a trusted advisor to help them understand how decisions around Social Security and Medicare will impact their finances,” said Nationwide Advanced Consulting Group Director George Schein. “Farmers need expertise to help transition their farms to the next generation. And they need to create a source of retirement income.”

“Farmers need a trusted advisor to help them understand how decisions around Social Security and Medicare will impact their finances,” said Nationwide Advanced Consulting Group Director George Schein. “Farmers need expertise to help transition their farms to the next generation. And they need to create a source of retirement income.”

Social Security retirement benefits are available starting at age 62. But taking your benefit as soon as possible leads to reduced monthly payments. For that reason, many choose to delay until full retirement age or age 70 (when benefits stop growing).

Delaying benefits as long as you can is a good rule of thumb. But that’s not always best for farmers.

“Some farmers may not expect to live into their 80s. Those farmers are more likely to choose the reduced payments that begin before their full retirement age,” Schein said. “Some farmers may also start Social Security benefits early because they plan to rely on the steady source of income it provides to cover the costs of Medicare premiums, which generally start at age 65.”

It’s a good idea to talk to a financial professional as early as your 40s or 50s to ensure you qualify for benefits. You need at least 10 years of taxable income to be eligible.

“A downside of today’s tax laws for farmers is that some may offset their farm’s annual income entirely and miss out on Social Security altogether,” Schein said. “By addressing this while there’s still time, a farmer can make the most of this important benefit.”

Learn more about Social Security disability for farmers from Nationwide’s Land As Your Legacy team or get connected to a financial professional who can provide even more personalized guidance.

Most U.S. citizens become eligible for Medicare at age 65 if they’re either qualified to collect Social Security benefits, a U.S. citizen or if they’ve been a permanent resident for at least five years.

With a few limitations, the federal program covers a portion of many common medical expenses like:

But there are also exclusions, namely:

Additional coverage is available from private insurers and should be considered by those 65 and older. The annual open enrollment window is the key time for these decisions. It begins in mid-October and runs through early December.

“Planning for current and future medical care and how to pay for it is even more critical for farmers because of the physical nature of their work and a lack of quality health care in many rural areas,” Schein said.

Nationwide’s Land As Your Legacy team can help further make sense of both Medicare and Social Security for farmers. Get connected to a financial specialist who can help protect your farm, family and future by visiting Nationwide.com/YourLand.

*A.M. Best Market Share Report 2020. Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Subject to underwriting guidelines, review and approval. Products and discounts not available to all persons in all states. Nationwide Investment Services Corporation, member FINRA. Nationwide, the Nationwide N and Eagle and Nationwide is on your side are service marks of Nationwide Mutual Insurance Company. ©2022 Nationwide.

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

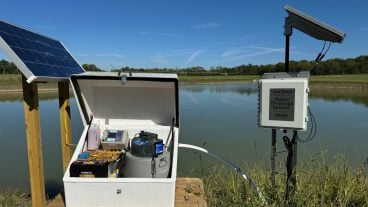

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More

Learn more about the Health Benefits Plan as well as new options coming for farm families, plus, get propane handling safety tips from Nationwide.

Read More

By understanding the dangers and taking these precautions, farmers can safely harness the power of propane.

Read More

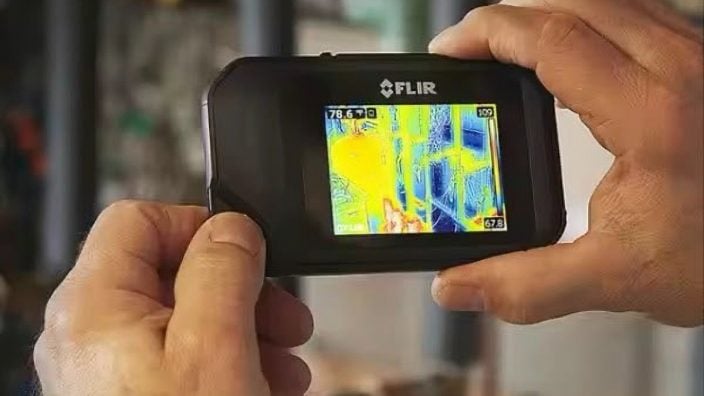

Ohio Farm Bureau’s Heritage Partner Nationwide teams up with leading agtech companies to offer innovative protection solutions that can help reduce losses and boost productivity.

Read More