A decade of action: Grain bin safety for 2026

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read MoreNationwide has solutions whether a beginning farmer, an established operation or if thinking about the future of the farm.

The following information is provided by Nationwide, the No. 1 farm and ranch insurer in the U.S.*

Life insurance can protect your family and your business in more ways than you might think. If you’re a beginning farmer, it can provide your family with financial stability in your absence. It is also instrumental in helping your farm continue after illness, retirement, or if you pass away. It can even help provide needed funds should something happen to one of your operation’s most valuable employees.

1. Term policies can help beginning farmers

If you’re younger or just beginning your farm, you’ve likely taken on some debt…maybe even a hefty amount of it. After covering your family’s living expenses and paying on your farm’s debt, there may not be much left over in your family’s bank account.

That challenge is exactly why term insurance is so important. Term policies provide life insurance coverage at the lowest cost and can help your family cover your personal or business debts. It can also create an emergency cash fund or provide needed financial support while your family gets back on their feet.

“As a farmer just getting started, you may have incurred personal debt in order to finance the growth of your farm. This debt has a life of its own and will survive your premature passing. This debt means that less of your assets will be available to support your loved ones,” according to Nationwide Advanced Consulting Group Director Steve Hamilton. “A level term life insurance policy that protects your family through the life of your loan is an easy and cost-effective way to help make sure your debt does not burden your loved ones after your passing.”

2. Universal life policies for established farmers

If you’re a more established farmer with a higher-value operation, there’s an additional benefit that can come with a permanent life insurance policy. Whether you’re concerned about protecting your family or your savings, universal life policies can provide:

“More established farm operators can consider adding a permanent, cash-accumulating life insurance policy to their personal balance sheet,” Hamilton said. “Farms, land and equipment all possess varying degrees of liquidity risk. If your family needs funds quickly after your passing, an asset may not sell quickly or profitably when there’s a lack of demand. Whether the policy allows your family to bide time for a better offer or allows your family to keep the tractor running if you’re not around, a permanent, cash-accumulating life insurance policy can become the cornerstone of a farming family’s financial plan.”

3. A survivorship life policy for the future of your farm

When planning the future of your operation, the right life insurance policy can help ease the financial pains of transitioning the farm. A survivorship life insurance policy is an option to consider.

“A buyout of your farm funded with a survivorship life insurance policy can ensure that your farm’s successors have the funds to purchase your operation or that your spouse and children that may not work the farm receive the financial benefits of your life’s work,” Hamilton added. “Even if the next generation is not your successor, a buyout funded with life insurance amongst future or current co-owners can help the farm continue operating while your family is financially taken care of.”

If you’re interested in exploring your life insurance options to secure your family’s or your farm’s financial future, don’t wait. Get connected to a financial specialist who can help protect your farm, family and future by visiting Nationwide.com/YourLand.

Photo credit: Zachary Sinclair, Unsplash

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

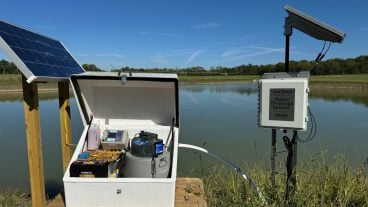

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More

Learn more about the Health Benefits Plan as well as new options coming for farm families, plus, get propane handling safety tips from Nationwide.

Read More

By understanding the dangers and taking these precautions, farmers can safely harness the power of propane.

Read More

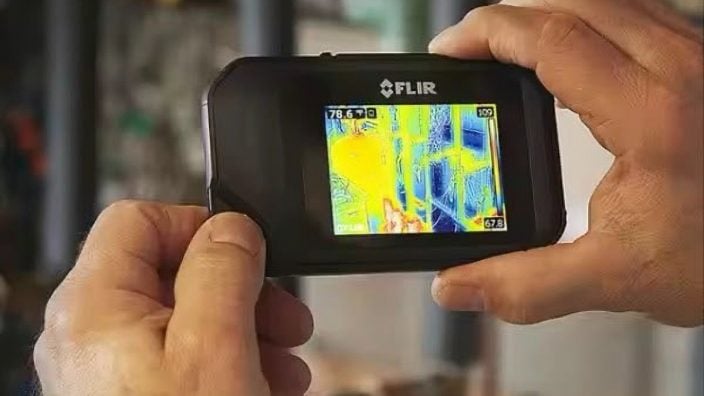

Ohio Farm Bureau’s Heritage Partner Nationwide teams up with leading agtech companies to offer innovative protection solutions that can help reduce losses and boost productivity.

Read More