Recent H-2A program impacts aim to steady farm labor costs, needs

A recent state budget fix and a federal rule reform to H-2A have resulted in some relief for farmers who use the guest worker program.

Read MoreThe Senate version of Ohio’s state budget for 2024-2025, which was passed on Thursday, has a significant provision that could mitigate CAUV increases.

The Senate version of Ohio’s state budget for 2024-2025, which was passed on Thursday, has a significant provision that could be very favorable for Ohio Farm Bureau members.

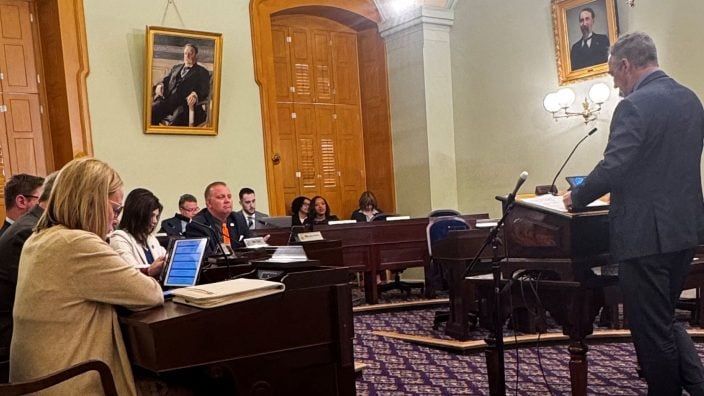

One of the items Farm Bureau advocated heavily for and made significant progress on this week will avert potential negative impacts of a proposed property tax policy change in the state budget bill. The Senate added a provision to its version of the bill that requires Current Agricultural Use Value to be averaged over a three-year period, which may lead to lower tax bills for landowners.

Lawmakers had proposed to take a similar approach to calculating values for residential property in an earlier version of the bill, but not farmland, likely resulting in a shift of local property tax burden to agriculture rate payers.

Ohio Farm Bureau members sprung into action by sending over 1,000 messages to policymakers using an action alert issued by the organization. As a result, Farm Bureau staff worked closely with lawmakers to find a solution to help mitigate the expected CAUV increases.

“We made great progress this week, but our work isn’t done yet,” said Brandon Kern, Ohio Farm Bureau senior director of state and national policy. “Policymakers need to continue to hear from our members about the importance of this provision so it isn’t removed from the final version of the bill.”

The next step in the budget process is the formation of a conference committee, composed of members of the House and Senate, to hash out differences between the two chambers’ versions of the bill. The result of that process will produce the final version of the bill that will be sent to Gov. DeWine for his signature before the July 1 deadline.

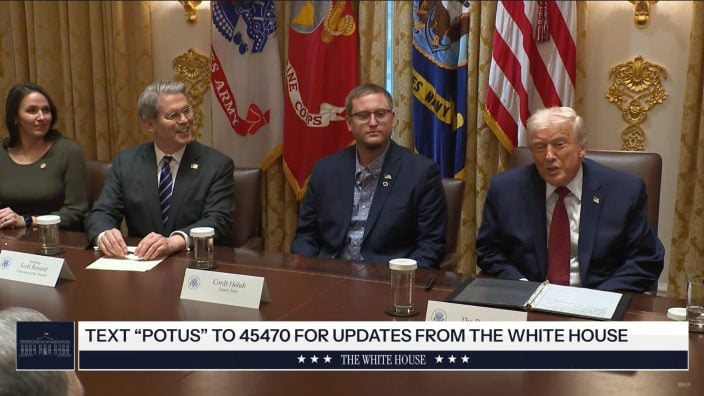

A recent state budget fix and a federal rule reform to H-2A have resulted in some relief for farmers who use the guest worker program.

Read More

Ohio Farm Bureau brought forth 10 policies to be voted upon by delegates at the American Farm Bureau Annual Convention in Anaheim earlier this week, and all 10 were approved as national policy.

Read More

Ohio EPA has recently proposed allowing data centers to obtain ‘general’ National Pollutant Discharge Elimination System (NPDES) permits for their stormwater/wastewater discharges.

Read More

Delegates discussed many topics impacting agriculture including farmland preservation, local foods, and succession planning.

Read More

Ohio Farm Bureau Treasurer Adele Flynn participated in the meeting, representing Ohio farmers.

Read More

HB 10 ensures transparency around how imitation meat is labeled, along with restoring needed flexibility around the application of crop protection tools.

Read More

The budget includes funding for: H2Ohio, animal health and animal disease response, the College of Veterinary Medicine at Ohio State, and the Brownfield Remediation Program.

Read More

The Pickaway County Farm Bureau Board of Trustees invites you to attend our Policy Development Breakfast at 8:30 a.m. on Wednesday, June 11, 2025.

Read More

The Fairfield County Farm Bureau Board of Trustees invites you to attend our Policy Development Breakfast at 8:30 a.m. on Tuesday, June 24, 2025.

Read More

Plans would be for Ohio farm families who do not have access to health insurance as an employee benefit or who are uninsured or underinsured due to high costs and limited options in the marketplace.

Read More