Applications for Ohio Farm Bureau Health Plans now available

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read MoreOhio Farm Bureau Health Plans are for individuals and families who may lack access to an employer-sponsored health plan, or those who may be overpaying or getting coverage that doesn’t fit their needs. This is especially important for those who are self-employed or part of farm households.

The Ohio Farm Bureau Health Benefits Plan is for small businesses and agribusinesses that want to offer health coverage to employees and their families.

Both fall under the umbrella of Ohio Farm Bureau Health Care Solutions, but they serve different needs. They are two plans, under one trusted name-offering choice, affordability, and reliability for all types of Ohio Farm Bureau members.

No. The Ohio Farm Bureau Health Benefits Plan was created in 2017, and is currently providing health care coverage to over 2,300 OFBF members and their families. Health Benefits Plan will continue to successfully serve employers and small businesses, and there are no planned changes. The new Farm Bureau Health Plans is an additional health care option for Farm Bureau members.

Ohio Farm Bureau staff and agents across the state are working hard to be able to offer the new Farm Bureau Health Plans in the fall. This will make the policies effective Jan. 1, 2026.

Editor’s Note: The Farm Bureau Health Plans are no open for enrollment. Visit the website to see the plan choices and to apply.

Through a third-party administrator, Ohio Farm Bureau Health Plans will offer comprehensive coverage featuring many essential health benefits, including: office visits, hospitalization and telemedicine; prescription drug benefits; preventive, routine and wellness services; maternity, newborn and pediatric care; mental health and substance abuse counseling and treatment; emergency room services; dental and vision coverage; outpatient services; rehabilitative services and devices; and laboratory services, just to name a few.

Ohio Farm Bureau hosted a webinar this fall; please see the recording below. Billy Fields, director of state alliance operations at Farm Bureau Health Plans, gave more context to the plans and answered questions.

Once accepted, Ohio Farm Bureau members will not lose their coverage as long as they continue paying their premiums and maintain their membership with Ohio Farm Bureau. Coverage will continue to be available without the threat of cancellation due to health conditions. However, premium rates could change over time based on the overall performance of the risk pool or as individuals age.

Ohio Farm Bureau Health Plans is subject to Ohio consumer protection laws through the Ohio Attorney General’s office. Additionally, the organization will voluntarily adhere to ACA-mandated appeal structures for coverage denials, including both internal and external review processes. To further ensure public confidence, Ohio Farm Bureau will incorporate a grievance process equivalent to ACA standards into its contracts. Any individual with concerns will have the option to file a complaint with the attorney general.

For many people who don’t qualify for ACA subsidies, Marketplace premiums are simply unaffordable. The Ohio Farm Bureau Health Plans will offer a lower-cost alternative, often with significant savings over ACA plans – while still providing comprehensive coverage, including access to trusted provider networks and strong claims support.

In most cases, yes. The plan partners with United Healthcare, a major insurance provider, giving you access to wide provider networks across Ohio. That means you’re likely to keep seeing the providers you already know and trust. It’s one of the most frequently cited benefits by current enrollees.

If you’re self-employed or working on a family farm, you may be overpaying or getting coverage that doesn’t fit your needs. This plan is built specifically for people like you, with competitive rates, reliable coverage, and less red tape. It’s designed to reduce financial stress and help more families focus on their farm or business without sacrificing their health security.

No. While the term “insurance” is often used broadly, it has a specific legal definition under state regulations. A fully insured product is subject to state oversight, whereas self-insured employer groups and similar models are not legally classified as “insurance.” State law now allows Ohio Farm Bureau to offer its members this new health coverage that falls outside the traditional insurance category. Because these new plans are not classified as insurance, Ohio Farm Bureau has the flexibility to consider individual health circumstances and design coverage options that better meet the needs of its members. These plans will be supported by contractual obligations, the resources of Ohio Farm Bureau and its affiliated companies, and reinsurance. Coverage will also include access to an expansive national provider network.

The member must have a primary residence in Ohio. If they currently live in Ohio and move out of state, they can keep their plan as long as they remain an Ohio Farm Bureau member.

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read More

Learn more about the Health Benefits Plan as well as new options coming for farm families, plus, get propane handling safety tips from Nationwide.

Read More

On this Ohio Farm Bureau Podcast, the top broker in the state for the Ohio Farm Bureau Health Benefits Plan shares why members are excited about this option.

Read More

Ohio Farm Bureau is pursuing an option that would provide a competitive and innovative alternative for members who do not easily fit into traditional health plan coverage.

Read More

The answer lies in first understanding the macro trends shaping American agriculture, the operating environment farms will find themselves in and the innovation required to remain resilient and profitable into the future.

Read More

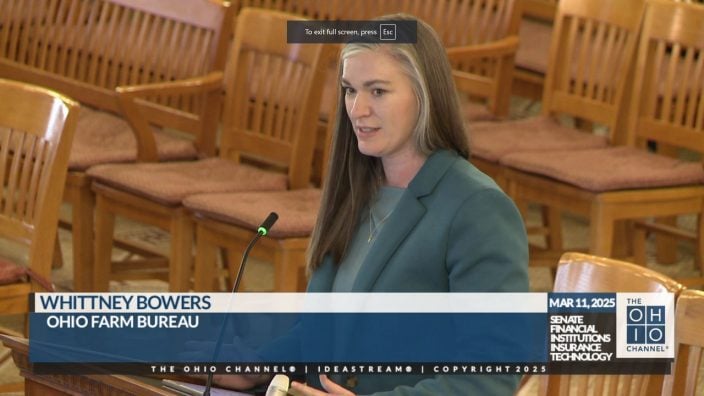

SB 100, championed by Sen. Susan Manchester, would offer farm families access to affordable, personalized health care plans.

Read More

SB 100 will allow Ohio to join the existing network of state Farm Bureaus participating in Farm Bureau Health Plans, which is an alternative health plan that has been serving Farm Bureau members since 1993.

Read More

Learn about legislation that would create Farm Bureau Health Plans and how that could benefit you and your family, on this Ohio Farm Bureau Podcast.

Read More

The plan provides a blueprint for policymakers and Ohio Farm Bureau members to bolster Ohio’s agriculture industry and our rural communities.

Read More

Innovative legislation to expand affordable health care access to rural Ohioans has been introduced in the Ohio Legislature and has…

Read More