Ohio Farm Bureau Podcast: Racing to County Fairs and a Federal Policy Update

Get an update on what to expect at the county fair tracks this year, Plus, find out about legislation that will have a direct impact on farmers.

Read More

Get an update on what to expect at the county fair tracks this year, Plus, find out about legislation that will have a direct impact on farmers.

Read More

The proposed tax package makes permanent several provisions from the TCJA that were previously set to expire. It also expands upon these provisions to provide additional opportunities.

Read More

Who must pay the CAT tax? What are taxable gross receipts? How and when are CAT taxes due? This article provides a brief overview of Ohio’s Commercial Activity Tax obligations.

Read More

To ensure that your farm and family receive competent guidance, proactive scheduling will be critical in the early part of 2025.

Read More

Ohio Farm Bureau is continuing to work multiple channels to address concerns around CAUV – particularly the issue of values spiking significantly.

Read More

Kelly Tennant’s story starts as many others in agriculture do, but her current day job impacts Ohio ag more than most.

Read More

Learn more about eligibility and how to include conservation practices on CAUV enrollment forms.

Read More

Bob and Polly Givens are on a mission to inform small landowners-homesteaders of the advantages of CAUV.

Read More

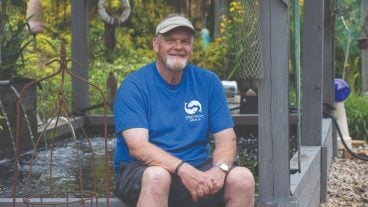

Mark DePugh was on the fence about renewing his CAUV enrollment, until he realized the amount of tax savings he would be missing.

Read More