Gerber Insurance & Financial Services sponsors Young Ag members

This donation helps the youth in our community be able to be a member of Farm Bureau and continue to support agriculture!

Read MoreOhio Treasurer Robert Sprague has announced a series of exciting changes that have made Ag-LINK more accessible and beneficial than ever before.

The 2022 Ag-LINK application period opened in February. At that time, Treasurer Sprague announced that – for the first time in the program’s history – the Ag-LINK application would be accepted year-round. Through this new and expanded application window, Ohio’s farming community now has enhanced access to lower-cost capital whenever they may need it most.

April saw passage and enactment of the Ohio Gains initiative, an effort aimed at modernizing various investment strategies within the treasurer’s office. Sprague’s Ohio Gains proposal cleared the General Assembly with unanimous, bipartisan support.

Through the bill, agricultural co-ops have joined Ohio’s farmers and agribusinesses as eligible borrowers under the Ag-LINK program. Additionally, individual loan caps have been removed from statute – making it easier for Ag-LINK to keep pace with changes to economic conditions. Previously, loans made through Ag-LINK were capped at a maximum amount of $150,000 per loan per year. That is no longer the case, as our farming community now has access to enhanced borrowing at reduced rates through the Ohio Gains initiative.

The treasurer’s office is proud of this work, and knows it was only made possible by working closely with members of the agriculture community. The treasurer’s office also hopes to build on this recent success and continue finding new ways to put Ohio’s balance sheet to work for Ohioans.

“Calling the current economic situation ‘complicated’ would be an understatement. From 40-year high inflation and skyrocketing energy prices to ongoing supply chain issues and rising interest rates, Ohio’s families and job creators are facing unprecedented challenges. And with this year’s growing season underway, our farmers are especially feeling the strain,” Sprague said.

While they face no shortage of roadblocks this year, the treasurer’s office is ready to offer support.

For more than three decades, the Ag-LINK program has helped farmers and agribusinesses drive down the cost of doing business by providing interest rate reductions on new or existing loans. Borrowers use Ag-LINK to finance upfront operating costs for feed, seed, fertilizer, fuel and other expenses.

Over the last year, Sprague has traveled across the state to speak directly with farmers, cooperatives, financial institutions and others in the agriculture community to hear more about how inflation and other economic challenges are impacting the industry. While Ag-LINK has a long track-record of success and remains widely popular, his takeaway from these conversations was clear – we could do more.

In previous years, the Ag-LINK application period only lasted a few months. But now, for the first time ever, the applications will be accepted year-round. Transitioning to a year-long application period provides borrowers with greater flexibility and ensures they can access capital whenever they need it most. This change also makes Ag-LINK more convenient for both crop and livestock farmers with diverse borrowing needs.

As part of the recently passed Ohio Gains legislation, the treasurer’s office has modernized its investment strategies to generate further cost savings opportunities for the agriculture community. Ag-LINK has been updated to improve accessibility and convenience, while making the program more relevant to the ever-evolving borrowing needs of today’s agriculture industry – helping farmers to save more money during these uncertain economic times.

Included in the legislation is the addition of agricultural cooperatives as eligible borrowers under Ag-LINK. Co-ops face many of the same challenges as other farmers and agribusinesses that are already served through Ag-LINK. Opening the program to co-ops further recognizes their valuable contributions to Ohio’s economy and agriculture industry. Additionally, the legislation removed outdated caps on loan size, allowing the program to keep pace with modern borrowing needs.

Lowered borrowing costs can make the difference between being in the black or being in the red. With interest rates rising, the rate reduction offered through Ag-LINK becomes even more meaningful. The treasurer’s office will review Ag-LINK’s interest rate reduction on a quarterly basis, based on economic conditions. This will ensure that Ag-LINK reflects changes in the interest rate environment and remains relevant and impactful for the farmers who use it.

Here is a video of Ohio Treasurer Robert Sprague speaking about Ag-LINK.

To learn more about Ag-LINK click HERE.

This donation helps the youth in our community be able to be a member of Farm Bureau and continue to support agriculture!

Read More

The program equips teachers with the knowledge and resources to teach students about the vital role bees play in agriculture and the environment.

Read More

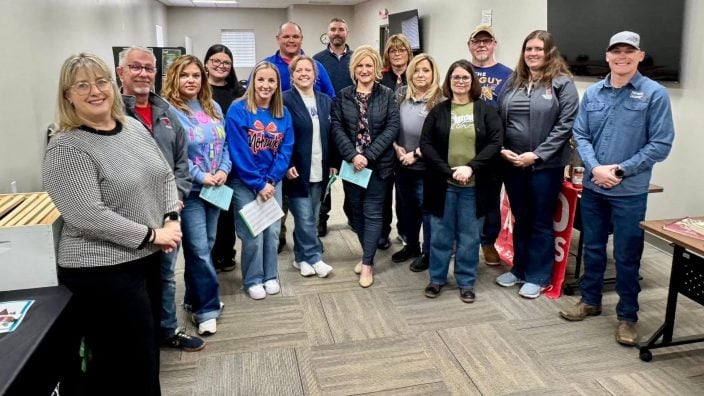

Volunteers reached out to individuals whose memberships had lapsed, were coming due for renewal, or who might be interested in joining for the first time.

Read More

This donation helps the youth in our community be able to be a member of Farm Bureau and continue to support agriculture!

Read More

Members may visit any time between 4-8 p.m. to cast their Annual Meeting ballot and to visit with board members.

Read More

Members, elected officials, and community leaders gathered to discuss property tax reform, land use regulations, and federal programs.

Read More

The Southern Ohio Ag Showcase was designed to provide agriculturalists with industry updates and networking opportunities within the southern Ohio region.

Read More

Members, elected officials, and community leaders gathered to discuss property tax reform, land use regulations and public safety.

Read More

Members, elected officials, and community leaders gathered to discuss property tax reform, land use regulations and public safety.

Read More

Local youth join Dr. Caleb Bohrer for hands-on calving demonstration and BQA training at United Producers Inc.

Read More