Applications for Ohio Farm Bureau Health Plans now available

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read MoreRecognizing the need to help the next generation of farmers get started in a very capital intensive industry, the Ohio House passed HB 95, creating the Ohio Beginning Farmer Tax Credit program. This was a priority issue for Ohio Farm Bureau, as it will help the next generation enter agriculture by removing some of the existing barriers to entry and exit.

Under HB 95, established landowners and ag producers can receive a state income tax credit when they sell or rent land or agricultural assets like machinery, building facilities or livestock to a beginning farmer. The credit is equivalent to 5% of the sale price, 10% of the cash rent or 15% for a cash share deal. Beginning farmers also can receive a tax credit up to $1,500 for taking a qualified financial management course, but do not receive tax credits for buying land or other farm-related items.

“This was an idea that came from Ohio Farm Bureau members who have dealt with the many obstacles of getting into and out of agriculture and worked through the policy development process to successfully add incentives for new and beginning farmers to the list of important issues Farm Bureau advocates for every day,” said Jenna Reese, Ohio Farm Bureau director of state policy. “The average age of the U.S. farmer is currently 58 and because they are aging at a quicker rate than new farmers are joining the profession, that number will continue to climb. Many beginning farmers do not have the levels of capital or credit necessary to begin farming, but even beyond that, the amount of land that is zoned for agriculture is finite. HB 95 will alleviate many of those issues.”

A beginning farmer is defined as someone who:

HB 95 now moves to the Ohio Senate for further consideration.

Members have three ways to apply: contacting a certified agent, calling 833-468-4280 or visiting ohiofarmbureauhealthplans.org.

Read More

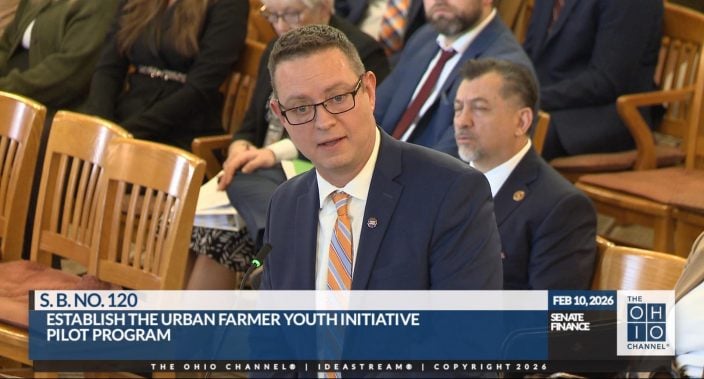

Introduced by Sen. Paula Hicks-Hudson, SB 120 would establish the Urban Farmer Youth Initiative Pilot Program.

Read More

Leah Curtis joins this Legal with Leah to talk about what data centers mean for local communities and how to stay engaged in the development process

Read More

Gases, vapors, and fumes can all create risk. How can we measure and protect ourselves from them?

Read More

The Ohio Farm Bureau’s Young Agricultural Professionals State Committee has named its 2026 leadership and the individuals who will be serving on the state committee for 2026-2028.

Read More

The Ohio Farm Bureau Foundation has multiple scholarships available to Ohio students from rural, suburban and urban communities who are pursuing degrees with a connection to the agricultural industry.

Read More

With 100% bonus depreciation now permanent, farmers can deduct the full cost of a new agricultural building in the year it’s placed in service.

Read More

A recent state budget fix and a federal rule reform to H-2A have resulted in some relief for farmers who use the guest worker program.

Read More

Ohio Farm Bureau advocated for a change in the law to allow family members and employees to handle pesticides while under the supervision of a licensed applicator. The rules around HB 10 are being finalized.

Read More

Lincoln Deitrick was named the Outstanding Young Farmer, Denver Davis won the Excellence in Agriculture Award, and Margaret Houts won the Discussion Meet.

Read More