Farmer’s Guide to Trucking Regulations available to Ohio Farm Bureau members

The guide includes a farm driver checklist, overview of state and federal regulations and exemptions, CDL qualifications and more.

Read More

Ohio farmland tax valuations continue to decline across the state according to a new study from Ohio State University. The study shows tax valuations have dropped by one third since the Current Agricultural Use Value formula was changed by the state legislature in 2017. Ohio Farm Bureau led the effort to make valuations more reflective of current farm economic factors.

Before the formula change, the average tax valuation of land in Ohio was $1,310 per acre. After the change, the average valuation was $875 per acre, according to the study done by agricultural economists Robert Dinterman and Ani Katchova with OSU’s College of Food, Agricultural, and Environmental Sciences.

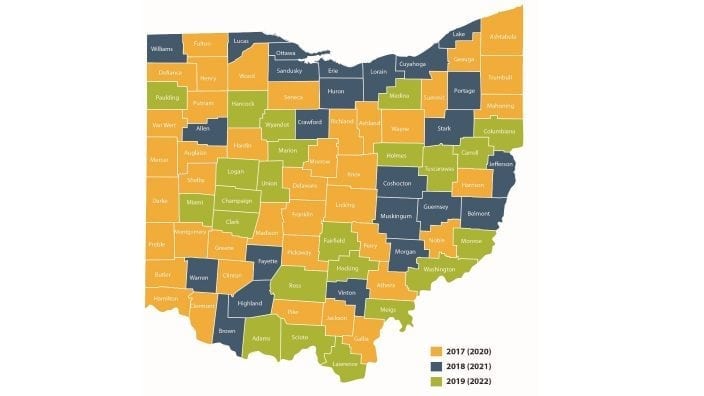

Agricultural land values and the corresponding taxes paid on that land will continue to decline at an even faster rate, Dinterman said. Steeper decreases in taxes will be seen, on average, because the changes to the way the farmland is assessed have been phased in between 2017 and 2019. Small changes were made each year to avoid a sudden and dramatic drop in tax revenue, Dinterman said.

But in 2020, the phase-in will end, so Ohio farmland owners should see another one-third drop in the assessed value of their land, compared to the previous year, and similar declines in their taxes, Dinterman said.

The average tax paid across the state was about $36 per acre of farmland in 2016. That dropped to around $31 in 2017, Dinterman said. By 2020, the average likely will be around $25 per acre, which would match the rate paid in 2011, he said.

The legislative adjustment to the CAUV formula followed three years of grassroots efforts by Farm Bureau members who asked lawmakers to respond to dramatically higher farmland taxes at a time when the farm economy was slumping.

“Ensuring that farmers have accurate property tax values is integral to preserving farmland in our state,” said Ohio Farm Bureau Policy Counsel Leah Curtis.

Another Farm Bureau promoted change is also paying off, she said.

“The penalty on farmers who place land in conservation practices has been eliminated,” Curtis said. “Conservation lands are now being taxed at a lower rate, which helps farmers continue their efforts to protect water quality.”

The guide includes a farm driver checklist, overview of state and federal regulations and exemptions, CDL qualifications and more.

Read More

The emergency fuel waiver to allow the sale of summer gasoline blends containing 15% ethanol will lengthen the period during which Americans can continue buying E15 from June 1 to Sept. 15.

Read More

The Small-Scale Food Business Guide covers federal and state regulations for selling food products such as raw meat, dairy, eggs, baked goods, cottage foods, fruits and vegetables, honey and more.

Read More

New resources and technology are broadening the different types of sales tools and strategies available to farmers.

Read More

ODA will enroll 500,000 acres into the program for a two-week sign-up period, beginning April 22, 2024, through May 6, 2024. Contact local SWCD offices to apply.

Read More

Katie Share of Columbus has been named ExploreAg and Youth Development Specialist for Ohio Farm Bureau.

Read More

Mary Klopfenstein of Delphos has been named Young Ag Professional and Ag Literacy Program Specialist for Ohio Farm Bureau.

Read More

The plan has been updated to give sole proprietors access to more rate stability and a smart solution that offers potential savings on health care.

Read More

The American Farm Bureau Federation, in partnership with Farm Credit, is seeking entrepreneurs to apply online by June 15 for the 2025 Farm Bureau Ag Innovation Challenge.

Read More

Adele Flynn of Wellington has been elected treasurer of the Ohio Farm Bureau Federation and now holds the third highest elected office in Ohio’s largest and most influential farm organization.

Read More