Washington County Farm Bureau hosts CAUV meeting

Leah Hetrick, from Ohio Farm Bureau, explained how CAUV works and how the equation used to determine property taxes works.

Read MoreAug. 29, 2023 | Program 7 – 8:30 p.m. Trade show 6 – 7 p.m. and 8:30 – 9 p.m.

Fisher Auditorium, OSU Wooster Campus | 1680 Madison Ave. Wooster, OH 44691

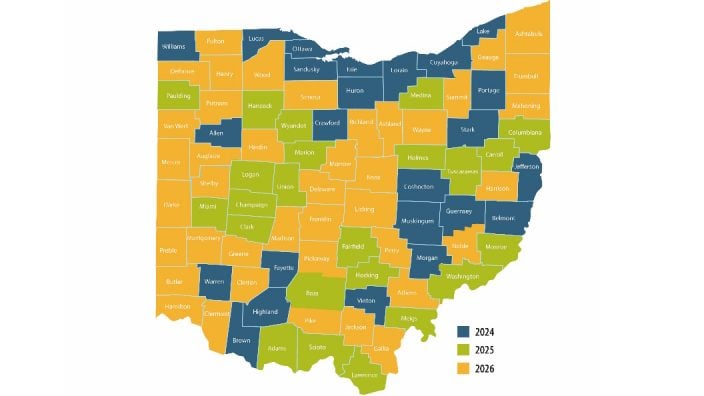

Who: CAUV landowners in counties with 2023 state mandated reappraisal and triennial updates who want to understand how and why CAUV soil values will adjust for the next three years.

Agenda

Welcome and Topic Introduction

Jarra Underwood, Wayne County Auditor, & Roger Baker, Ohio Farm Bureau District 8 State Trustee

Formula recap and what is expected for 2023 soil values in NE Ohio

Jack Irvin, Ohio Farm Bureau Vice President for Public Policy

Farmland market trends

Kelly Hettick, Wayne County Auditor’s Office In-House Appraiser

This event is free to Farm Bureau members (membership card must be presented to enter the meeting). Non-members can join their county Farm Bureau on-site and attend the meeting.

An opportunity will be available during the trade show for attendees to visit with their Auditor’s office staff to ask specific questions about their parcel.

Registration is highly encouraged. Please register at this link or by calling the Wooster Farm Bureau office at 330-263-7456.

Leah Hetrick, from Ohio Farm Bureau, explained how CAUV works and how the equation used to determine property taxes works.

Read More

As Ohio Farm Bureau Policy Counsel Leah Curtis notes in this Legal with Leah, these changes should result in significant tax savings for many Ohio woodland owners.

Read More

CAUV 202 took a deeper dive into how tax bills are formulated and what exactly goes into the Current Agricultural Use Value numbers.

Read More

After years of advocacy from Ohio Farm Bureau and its partners, the Ohio Department of Taxation announced today that it will address inaccurate woodland calculations in the Current Agricultural Use Value program.

Read More

Taking a look at the history of CAUV can help with understanding its structure, fluidity and the eternal vigilance needed by Ohio Farm Bureau and our members for its sustainability.

Read More

Kelly Tennant’s story starts as many others in agriculture do, but her current day job impacts Ohio ag more than most.

Read More

Learn more about eligibility and how to include conservation practices on CAUV enrollment forms.

Read More

Bob and Polly Givens are on a mission to inform small landowners-homesteaders of the advantages of CAUV.

Read More

With the pressure on Ohio farms, perhaps the most important way farmers can afford to keep farming is with the protection of CAUV.

Read More

Mark DePugh was on the fence about renewing his CAUV enrollment, until he realized the amount of tax savings he would be missing.

Read More