Ohio Farm Bureau Podcast: Racing to County Fairs and a Federal Policy Update

Get an update on what to expect at the county fair tracks this year, Plus, find out about legislation that will have a direct impact on farmers.

Read MoreOhio law allows for property taxes to be assessed on only 35% of the property’s value. Therefore, to determine the taxable value, you could multiply your appraised value by 0.35 to determine the value to which the tax rate will actually be applied. Editor's note: This article was reviewed in June 2025 for accuracy.

According to the constitutional requirements of Ohio’s property tax system, all land must be valued at its true value in money, except for property that can be valued using the Current Agricultural Use Value (CAUV) formula. Once the value of the property is established, the taxable value can be determined.

Tax rates can also be a source of confusion. In Ohio, property tax rates are expressed in terms of millage. One mill is equal to 1/1,000 of a dollar or $0.001. When reviewing your tax bill, you will see the tax rate expressed as a number, such as “75.55.” To determine what your taxes are from this rate, you would actually multiply the taxable value (appraised value x .35) by 0.07555.

There are two types of millage under Ohio’s property tax system: the so-called “inside mills” and “outside” or voted millage. Inside millage is so named because it is inside the purview of the Ohio Constitution to charge this amount on the tax bill. The Ohio Constitution states that property taxes shall be assessed at no more than 1 percent of value, unless otherwise approved by the electorate or provided for in a city charter. This means that the Ohio Constitution allows for the first 10 mills (or 1 percent) of property taxes on your tax bill without any prior approval or restrictions. These inside mills are distributed generally among your local governments.

“Outside” millage, or voted millage, is just that — millage that had to be approved by the voters before it could be applied to the tax bill. Any levies or bond issues that you have seen presented on your ballot, if approved, are part of the outside millage on your tax bill. This distinction will be additionally important when we discuss the House Bill 920 reduction factors that limit tax rates.

Get an update on what to expect at the county fair tracks this year, Plus, find out about legislation that will have a direct impact on farmers.

Read More

The proposed tax package makes permanent several provisions from the TCJA that were previously set to expire. It also expands upon these provisions to provide additional opportunities.

Read More

Who must pay the CAT tax? What are taxable gross receipts? How and when are CAT taxes due? This article provides a brief overview of Ohio’s Commercial Activity Tax obligations.

Read More

To ensure that your farm and family receive competent guidance, proactive scheduling will be critical in the early part of 2025.

Read More

Ohio Farm Bureau is continuing to work multiple channels to address concerns around CAUV – particularly the issue of values spiking significantly.

Read More

Kelly Tennant’s story starts as many others in agriculture do, but her current day job impacts Ohio ag more than most.

Read More

Learn more about eligibility and how to include conservation practices on CAUV enrollment forms.

Read More

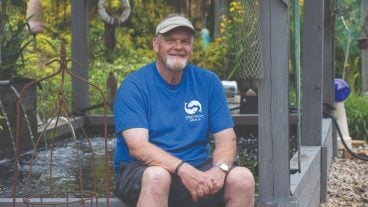

Bob and Polly Givens are on a mission to inform small landowners-homesteaders of the advantages of CAUV.

Read More

Mark DePugh was on the fence about renewing his CAUV enrollment, until he realized the amount of tax savings he would be missing.

Read More