At Nationwide, our past informs our future

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read MoreAs we continue to stay ahead of the curve for farmers and ranchers, find out how we can work together to protect your next.

Since our start as a small mutual auto insurance provider in 1926, Nationwide has watched farms evolve from horses and moldboard plows to drones and autonomous machinery. We’ve grown and evolved in that time, too.

As the No. 1 insurer of farms and ranches in the U.S.* and the exclusive property and casualty insurance provider for nine state Farm Bureaus (California, Connecticut, Delaware, Maryland, New York, Ohio, Pennsylvania, Vermont, West Virginia), Nationwide’s commitment to helping farmers and ranchers protect their next is stronger than ever.

Every time agriculture leaps forward, so do we. That’s what protecting your next is all about: always looking and planning ahead – working to provide the insurance products and services progressive farmers and ranchers need to succeed.

Today, that means staying on the leading edge of new tools, practices and technology farmers and ranchers need to get their jobs done. Our firm grasp on these types of changes means we’ll continue to offer the products and services our customers need, whether they’re working to better align with public interest or grow and diversify a farm or ranch.

“We are always challenging ourselves to identify ways we can evolve our products and services. We take our commitment to supporting farmers and ranchers’ changing needs very seriously,” said Brad Liggett, president of Nationwide Agribusiness. “Nationwide is there for you today. We’re also working hard to make sure we protect your next.”

Nationwide offers business solutions to help Farm Bureau members protect their next. That means business planning, insurance tools and transition expertise, including:

• Farm, commercial and surplus/specialty insurance products to protect your life’s work.

• Personal insurance products and services for homes, vehicles and personal liability.

• Financial service products like life insurance, annuities and retirement plans.

As a Farm Bureau member, you are eligible for special savings on your Nationwide farm policy. And you may be eligible for other benefits, such as:

• Emergency roadside assistance coverage.

• Identity fraud expense.

• Arson/crime reporting awards.

• Accidental death coverage for youth organization animals (4-H or FFA).

And our Ag Insight Center provides expert tips and insights to help you navigate the changing agricultural landscape, run a successful business and maintain the safety of your operation.

As we continue to stay ahead of the curve for farmers and ranchers, find out how we can work together to protect your next. Visit FarmAgentFinder.com to talk with a Nationwide Farm Certified agent or visit NationwideAgribusiness.com for more details.

* A.M. Best Market Share Report 2020. “FARM BUREAU” and the Farm Bureau mark are registered service marks of the American Farm Bureau Federation and used under license by Nationwide.

Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Subject to underwriting guidelines, review and approval. Products and discounts not available to all persons in all states. Nationwide Investment Services Corporation member FINRA. Home office: One Nationwide Plaza, Columbus, OH. Nationwide, the Nationwide N and Eagle and other marks displayed on this page are service marks of Nationwide Mutual Insurance Company, unless otherwise disclosed. ©2021. Nationwide Mutual Insurance Company.

As we pause this year to celebrate our centennial, we remain grateful for our long-term partnership with the Ohio Farm Bureau.

Read More

Legacy nutrient deductions enable new farmland owners to claim deductions on the nutrients within the soil on which healthy crops depend.

Read More

Farmers, agribusinesses and community members are encouraged to nominate their local fire departments for Nationwide’s Nominate Your Fire Department Contest through April 30.

Read More

As part of Grain Bin Safety Week, Nationwide and the National Education Center for Agricultural Safety are once again holding the annual Nominate Your Fire Department Contest.

Read More

Plan ahead, be attentive to changing weather and be ready to act when severe winter conditions endanger health and safety.

Read More

Nationwide’s Grain Bin Safety campaign expands its reach, delivering grain rescue tubes and training to 62 fire departments in 2025.

Read More

Ohio Farm Bureau Select Partners is an insurance and financial services preferred partnership program for Ohio’s agricultural community.

Read More

For more information or to sign up for weather alerts, farm policyholders should contact their Nationwide agent or visit ofb.ag/nationwideweatheralert.

Read More

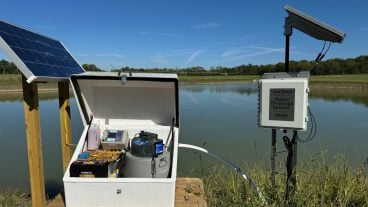

What if farmers could harness the moisture that falls during the winter season and use it when their crops are lacking water during the growing season — all with the touch of a button.

Read More

Is your property and pocketbook ready for what Mother Nature has in store?

Read More